Liquidity is one of the core competencies of cryptocurrency exchanges. High liquidity not only provides investors with lower trading costs but also ensures efficient execution of large orders and market price stability.

This article analyzes the liquidity performance of BTCUSDT and ETHUSDT perpetual contracts on three major trading platforms – B*fin, B*X, and Tapbit, exploring the differences in trading experience from three dimensions: order book depth, bid-ask spread, and slippage, to help investors make more informed choices.

II. Research Methodology

- Comparison Objects: B*fin, B*X and Tapbit

- Comparison Subjects: BTCUSDT and ETHUSDT

- Main Liquidity Indicators:

- Order Book Depth

- Bid-Ask Spread

- Slippage

III. BTC Perpetual Contract Liquidity Analysis

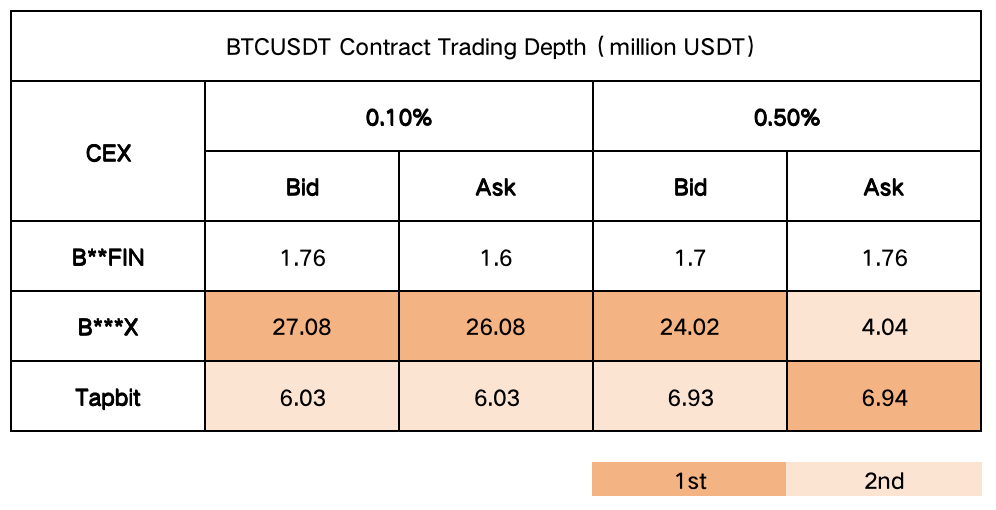

The trading depth, bid-ask spread, and slippage of BTCUSDT contracts on major platforms are as follows:

Trading Depth Analysis:

At trading depths of 0.10% and 0.50%, B*X‘s order book performance stands out, with trading depths far exceeding B*fin and Tapbit. Tapbit’s depth remains stable, slightly higher than B*fin, indicating that B*X has a significant advantage in executing large orders.

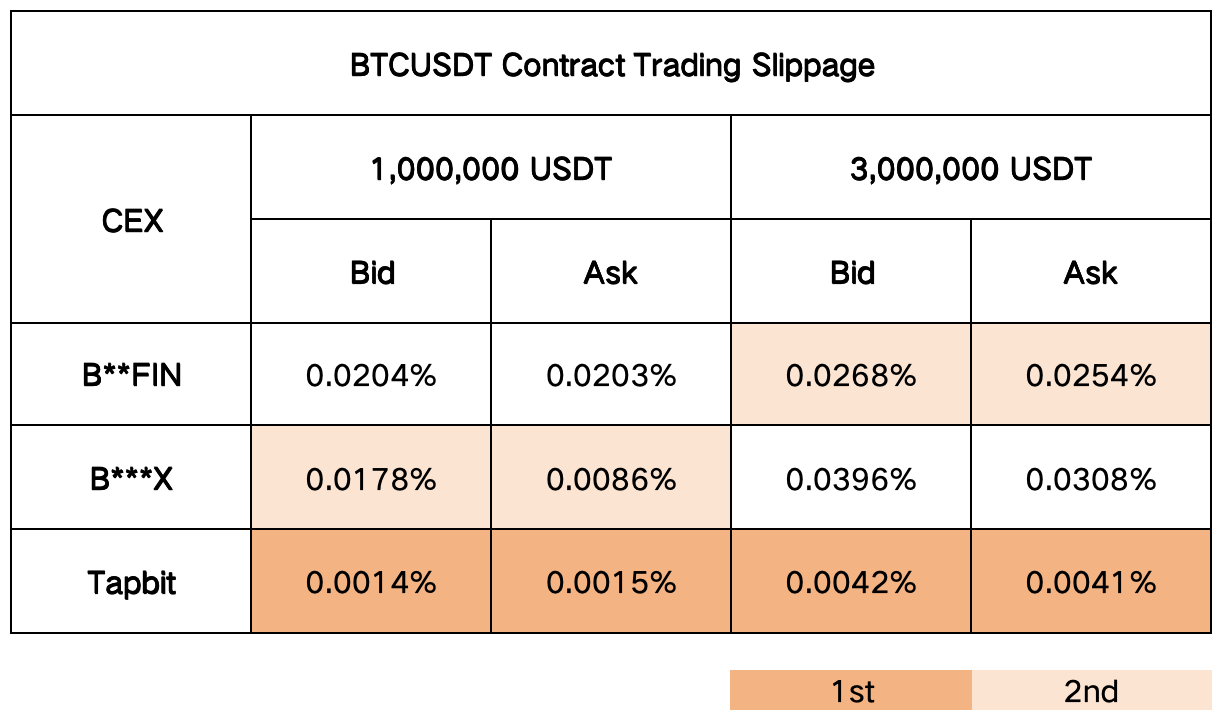

- BTCUSDT Contract Trading Slippage:

Slippage Analysis:

The slippage data shows Tapbit performs best in high-value trades, with significantly lower slippage than the other two platforms for both 1 million USDT and 3 million USDT trading volumes. This indicates Tapbit provides more stable trading prices for investors.

Comprehensive Evaluation: For BTCUSDT contracts, B*X dominates with deeper order books, but Tapbit’s superior slippage control makes it the preferred choice for low-cost trading.

IV. ETHUSDT Perpetual Contract Liquidity Analysis

For ETHUSDT contracts, the platforms show several highlights:

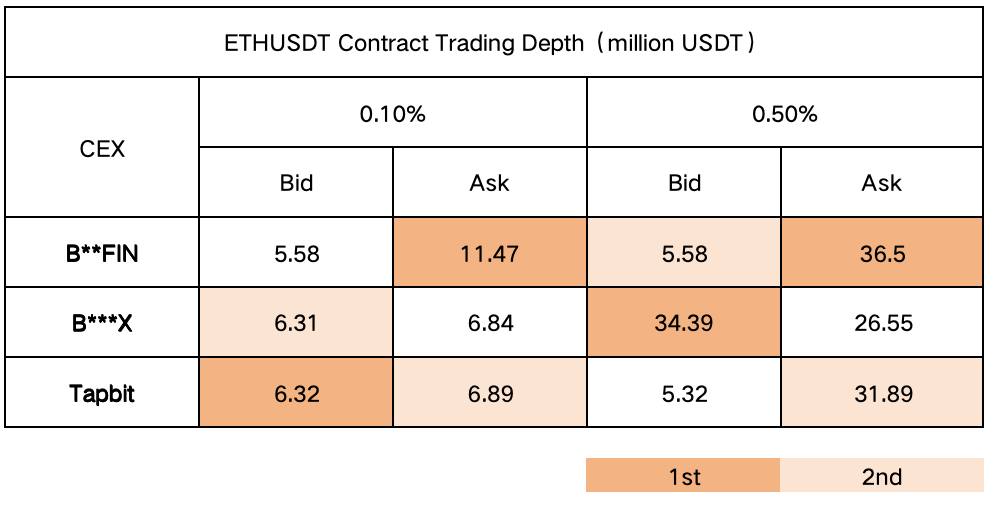

- ETHUSDT Contract Trading Depth:

Trading Depth Analysis:

In terms of ETHUSDT perpetual contract order book depth, platforms show relatively balanced performance. B*X leads at 0.50% depth, while Tapbit and B*X show little difference at 0.10% depth. B*fin’s performance is relatively weaker with limited depth.

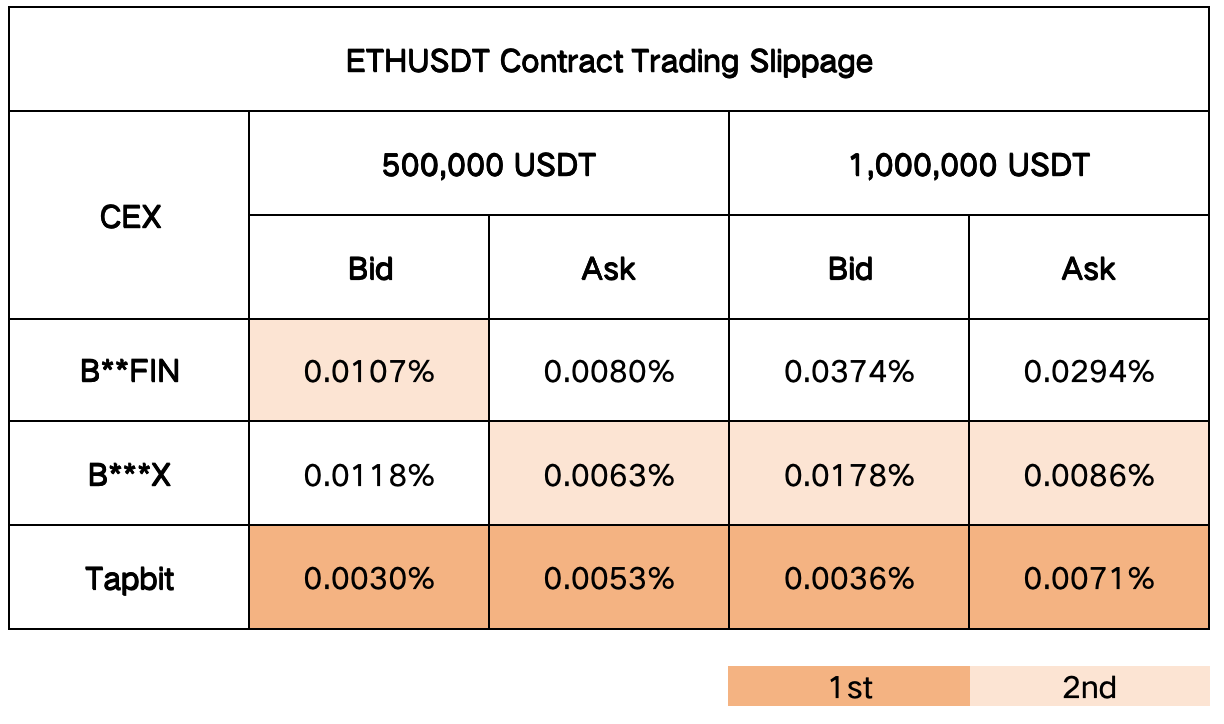

- ETHUSDT Contract Trading Slippage:

Slippage Analysis:

Tapbit again leads with the lowest slippage compared to competitors, particularly significant in large order execution. While B*X and B*fin have slightly higher slippage, they remain within reasonable ranges.

Comprehensive Evaluation: In ETH contracts, Tapbit has an advantage in slippage, suitable for price-sensitive investors, while B*X is suitable for large order execution with its depth advantage.

VI. Overall Assessment

Overall, B*X and Tapbit each have their advantages in liquidity indicators. B*X is suitable for investors requiring high trading depth, while Tapbit, characterized by low slippage, provides a better choice for refined trading. Investors can choose the appropriate platform based on their specific needs.