Liquidity is one of the core competencies of cryptocurrency exchanges. High liquidity not only provides investors with lower trading costs but also ensures efficient execution of large orders and market price stability. This article analyzes the liquidity performance of three major trading platforms—BT, BX, and Tapbit—in BTC and ETH perpetual contracts. By examining order book depth, bid-ask spread, and slippage, we explore the differences in trading experience across these platforms to help investors make more informed choices.

II. Research Methodology

Comparison Objects: B*T, B*X, and Tapbit

Comparison Targets: BTC and ETH

Key Liquidity Indicators:

Order Book Depth

Bid-Ask Spread

Slippage

III. BTC Perpetual Contract Liquidity Analysis

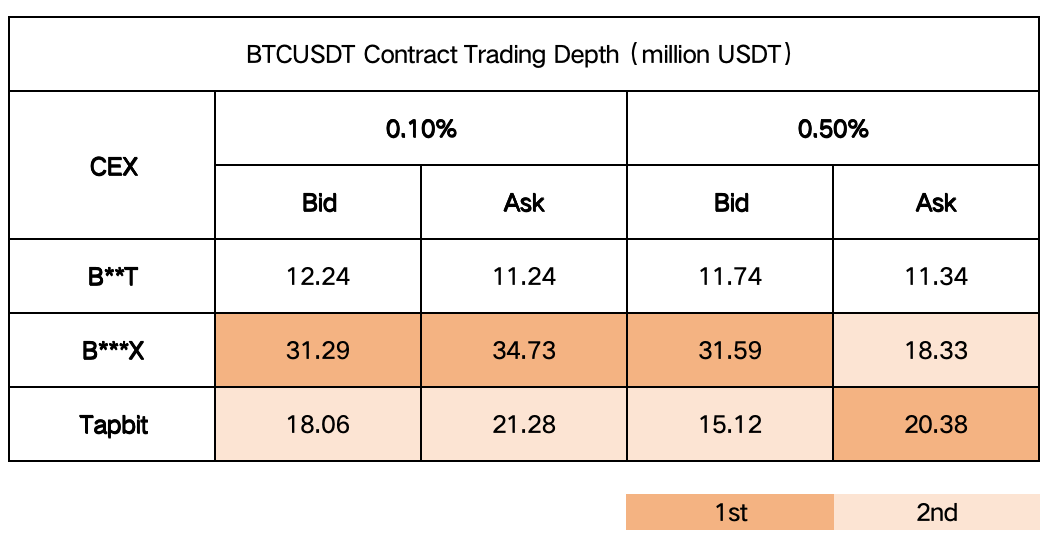

The trading depth, bid-ask spread, and slippage for BTCUSDT contracts on the major platforms are as follows:

BTCUSDT Contract Trading Depth (in million USDT):

Trading Depth Analysis:

BX performs exceptionally well in shallow depth, with its order book capable of handling large buy and sell volumes, showing a significant advantage. Tapbit maintains balance in deeper depth, while B*T’s overall depth performance is weaker.

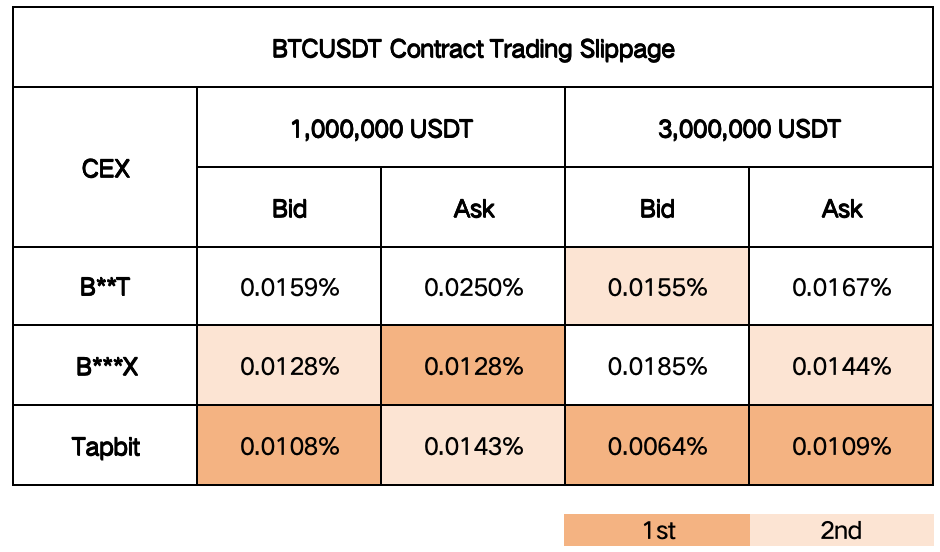

BTCUSDT Contract Trading Slippage:

Slippage Analysis:

Tapbit excels in slippage control, particularly in minimizing price deviation during large order executions, demonstrating a clear advantage. In comparison, B*X and B*T have slightly inferior slippage control capabilities.

IV. ETH Perpetual Contract Liquidity Analysis

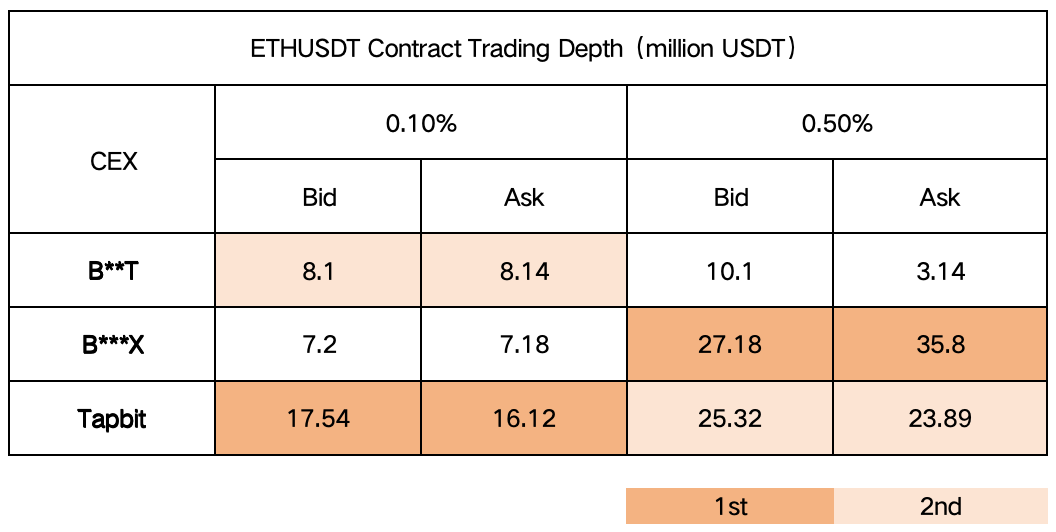

For ETHUSDT contracts, the platforms exhibit the following highlights:

ETHUSDT Contract Trading Depth (in million USDT):

Trading Depth Analysis:

Tapbit performs excellently in shallow depth, making it suitable for fast trading needs. B*X has an advantage in deeper depth, ideal for situations requiring larger market capacity. B*T’s overall depth remains weak.

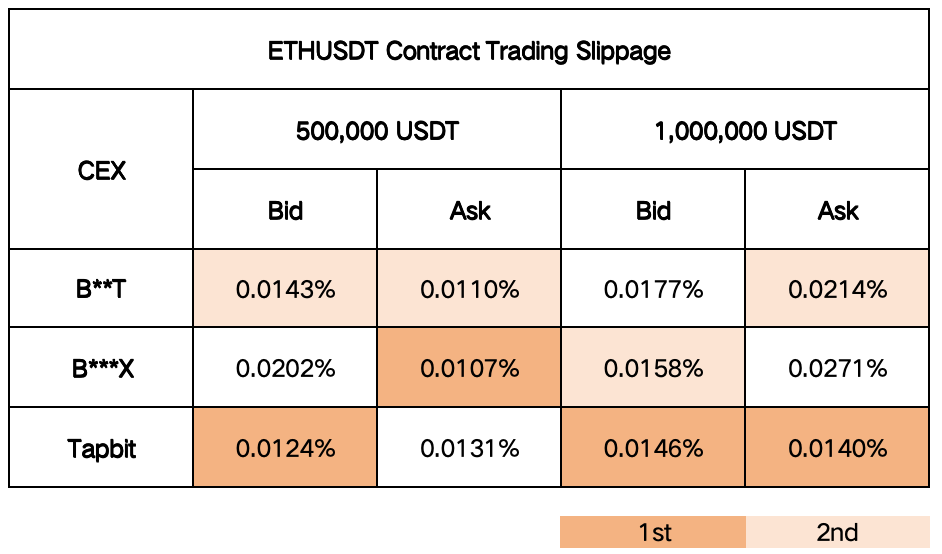

ETHUSDT Contract Trading Slippage:

Slippage Analysis:

Tapbit continues to lead in slippage control, demonstrating high stability, while the other platforms show relatively average performance.

V. Copy Trading and Liquidity Synergy

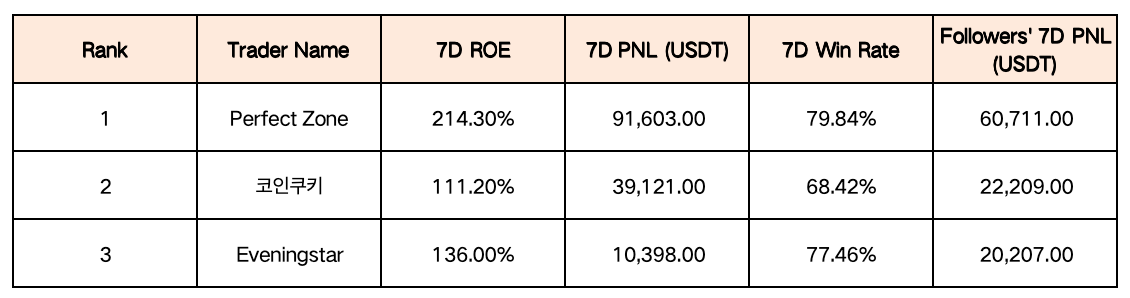

Tapbit’s outstanding liquidity in BTC and ETH perpetual contracts provides solid support for its Copy Trading system. The following data from Tapbit’s top traders over seven days validates the positive impact of liquidity on copy trading:

Liquidity Advantages:

Low Slippage and Sufficient Depth: Ensure traders can efficiently execute strategies, avoiding extra costs due to market fluctuations.

Stable Trading Environment: Followers achieve transaction prices highly consistent with the lead trader, enhancing the copy trading experience.

Efficient Order Execution: Supports large-scale copy trading while maintaining profitability.

Conclusion: Tapbit’s liquidity advantages not only enhance traders’ profitability but also create a stable income environment for Copy Trading followers, fully demonstrating the synergy between liquidity and innovative trading models.

VI. Comprehensive Evaluation

Tapbit: Strong slippage control, especially in large order execution, making it suitable for users seeking low-cost and efficient trading.

B*X: Trading depth is its biggest highlight, particularly suited for traders needing high market capacity support.

BT**: Overall liquidity performance is not outstanding, better suited for trading scenarios with lower depth and slippage requirements.