Whether you’re looking to hedge positions, leverage market opportunities, or diversify your trading strategy, Tapbit provides a secure and intuitive platform to trade futures without holding the underlying assets. In this guide, we’ll walk you through every step to start executing futures trading confidently and efficiently.

What Is Futures Trading?

Futures trading is a financial strategy that allows traders to buy or sell an asset at a predetermined price on a specified future date. Unlike spot trading—where assets are traded immediately, as detailed in our guide “How To Get Started With Spot Trading On Tapbit?“—futures trading enables participants to speculate on price movements without owning the underlying asset.

Futures trading is characterized by several defining features that collectively create a versatile trading environment. The use of leverage enables traders to control substantial positions with relatively small capital outlays, though this magnifies both potential gains and losses. The ability to take both long and short positions provides flexibility to profit in rising or falling markets, while the margin system—comprising initial and maintenance requirements—helps manage risk in leveraged positions.

How To Start Futures Trading On Tapbit?

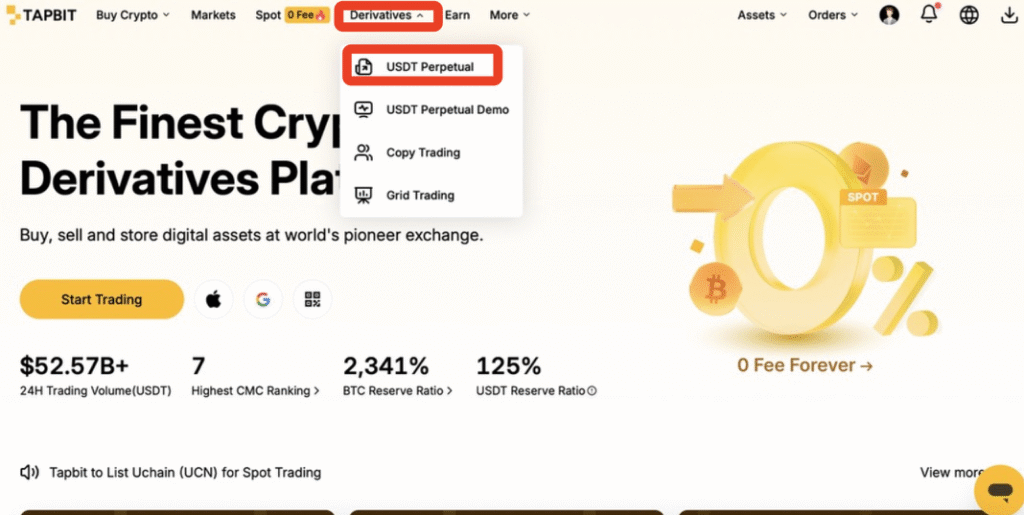

STEP 1: Access The Futures Trading Interface

Log in to your Tapbit account. From the homepage, click on “Derivatives” in the top navigation bar, then select “USDT Perpetual.

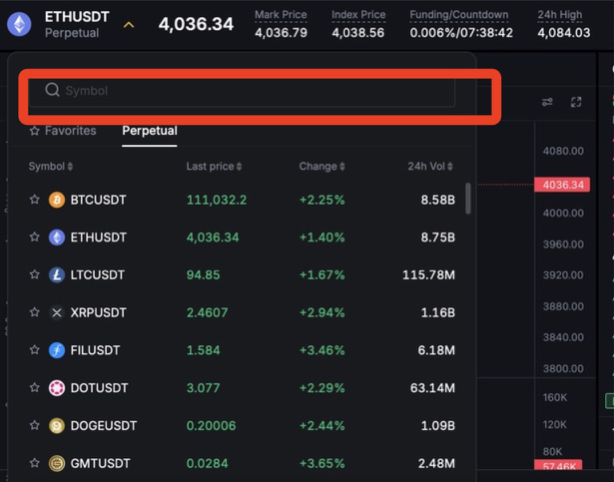

STEP 2: Select A Trading Pair

Use the search bar to find the futures contract you wish to trade (e.g.,ETHUSDT).

STEP 3: Configure Trade Settings And Place An Order

- Set Margin Mode

- Cross Margin: Uses your entire available account balance as collateral across all positions.

- Isolated Margin: Allocates a fixed amount of margin to a single position, limiting risk to that specific trade.

- Adjust Leverage

- Use the leverage slider or input box to set your desired multiplier. Higher leverage amplifies both potential profits and risks.

- For more details, you can refer to the article ‘What Is Leverage And How To Modify It In Futures Trading On Tapbit?‘

- Choose Order Type

- Limit Order: Execute at a specific price or better.

- Market Order: Execute immediately at the best available market price.

- For more details, you can refer to the article ‘What Is A Market Order And A Limit Order On Tapbit?‘

- Set Take-Profit/Stop-Loss (Optional)

- You can predefine your exit strategy by setting TP/SL levels to automatically lock in profits or limit losses

- For more details, you can refer to the article ‘How To Set TP And SL Orders On Tapbit?‘

- Enter Order Details

Input the quantity you wish to trade. Review all order parameters carefully, then, based on your market outlook:- Select “Open Long” if you anticipate a price increase.

- Select “Open Short” if you expect a price decrease.

Start Trading With Confidence

You now possess the essential knowledge to begin your futures trading journey on Tapbit. Remember to start with manageable positions, utilize risk management tools like TP/SL orders, and always trade according to your strategy. The platform’s intuitive interface and powerful tools are ready to support your every move.

Log in to your Tapbit account now and take the first step toward mastering futures trading. Your strategic trading journey begins today.