This research focuses on four of the most representative cryptocurrency trading platforms in the current market—OKX, GATE, BLOFIN, and TAPBIT—aiming to comprehensively evaluate their liquidity performance through both quantitative and qualitative analysis. As a key indicator of a trading platform’s core competitiveness, liquidity directly determines users’ trading efficiency, cost control, and risk management capabilities, while also providing users with a clearer and simpler understanding of liquidity metrics.

II.Research Methodology

Comparison Subjects: OKX, GATE, BLOFIN, TAPBIT

Comparison Assets: ETH and randomly selected SOL for this week

Key Liquidity Indicators:

- Order Book Depth

- Bid-Ask Spread

- Slippage

III.ETH Perpetual Contract Liquidity Analysis

The trading depth,bid-ask spread, and slippage for ETHUSDT contracts across major platforms are as follows:

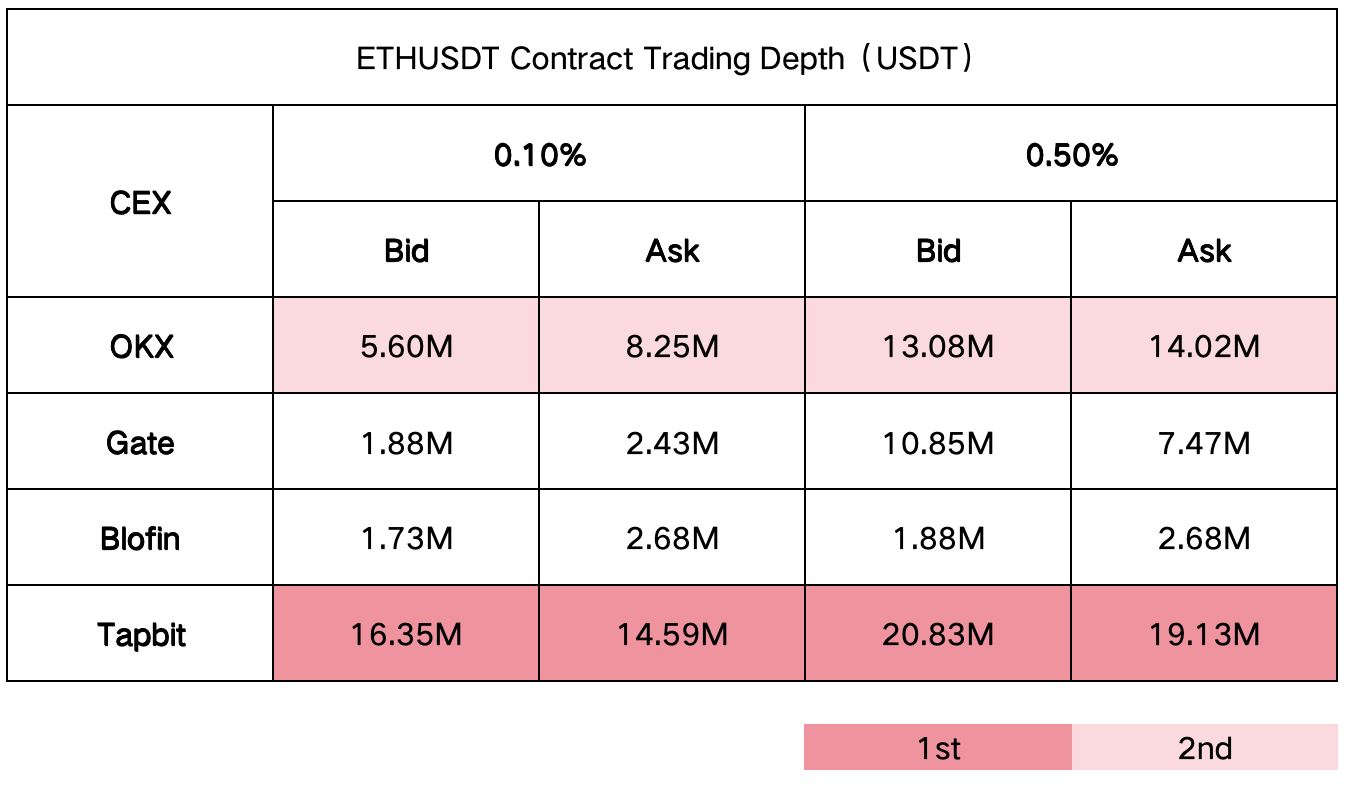

1.ETHUSDT Contract Trading Depth(Unit:USDT):

Tapbit’s high trading depth at 0.10% and 0.50% slippage levels indicates its capability to handle large transactions with minimal price impact, which is particularly important for institutional and high-volume traders. OKX demonstrates considerable depth, especially at the 0.50% slippage level, making it a viable option for large trades. Gate and Blofin show relatively lower trading depths, which may result in greater market impact when meeting high liquidity demands.

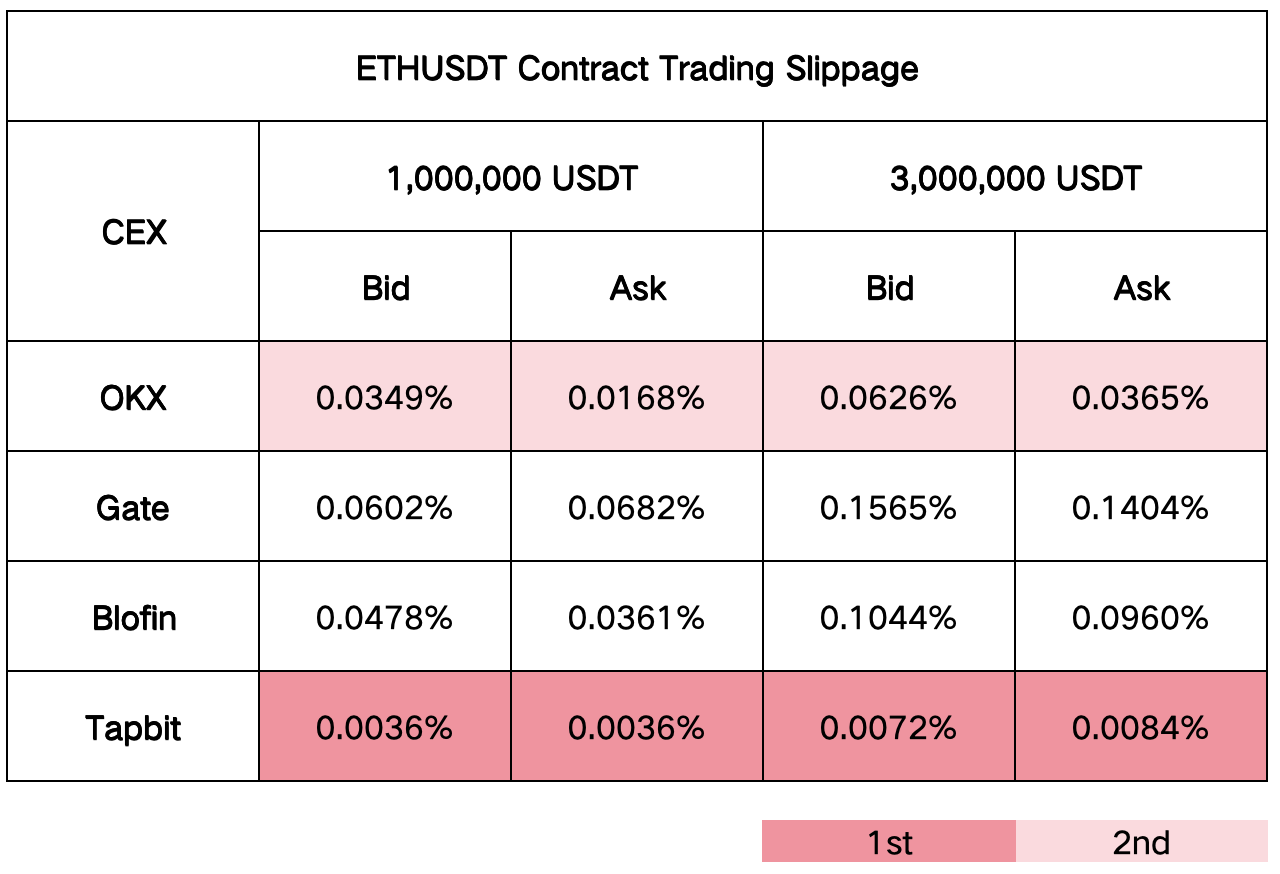

2. ETH Contract Slippage and Spread:

Tapbit demonstrates the lowest slippage across different trading sizes, indicating strong liquidity and order book depth.OKX maintains competitiveness, typically ranking second across all categories. Other exchanges(Gate and Blofin)show higher slippage, likely resulting in larger price fluctuations when handling large trades.

IV.SOL Perpetual Contract Liquidity Analysis

For SOLUSDT contracts, the platforms show the following highlights:

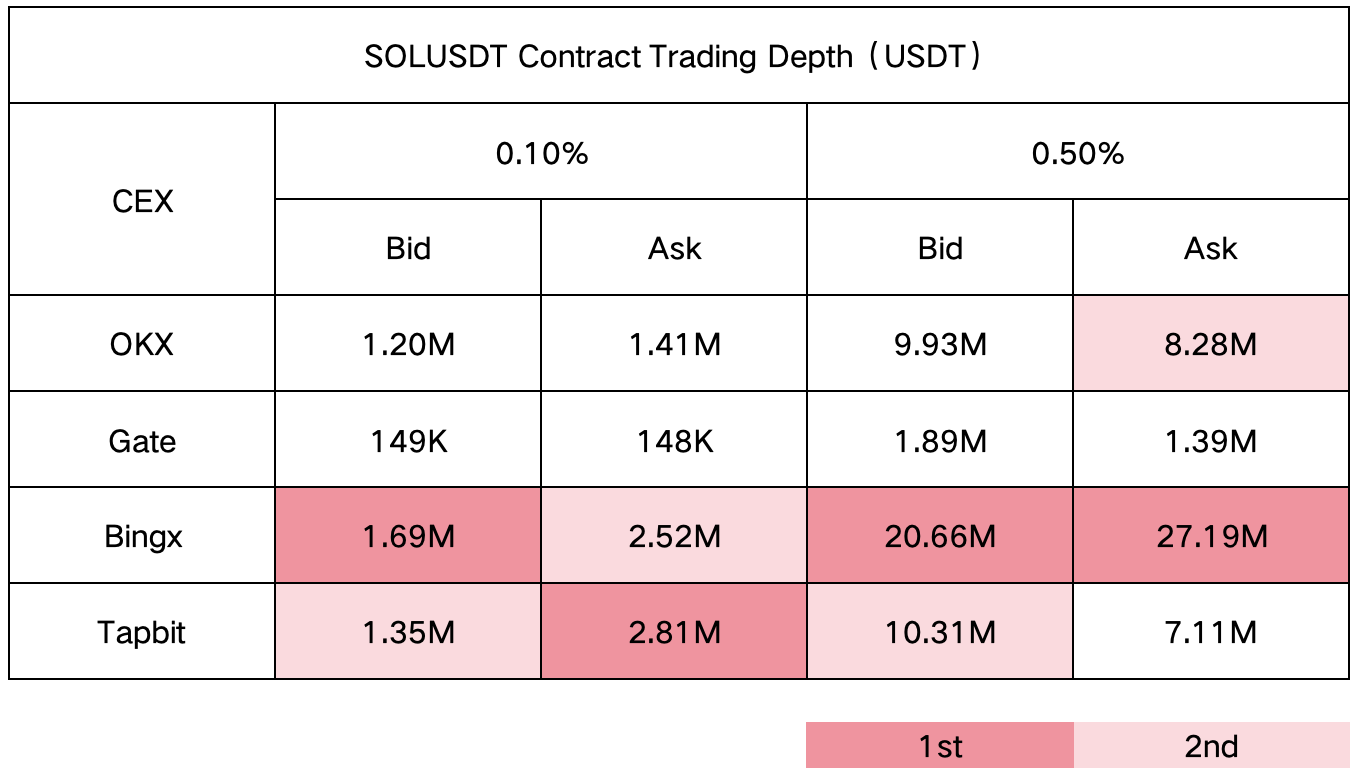

1. SOLUSDT Contract Trading Depth:

Bingx shows the strongest performance in most cases, particularly in buy/sell depth at 0.50% price deviation, indicating strong market liquidity support. Tapbit follows closely in-depth, particularly leading in sell-side depth at 0.10% price deviation.

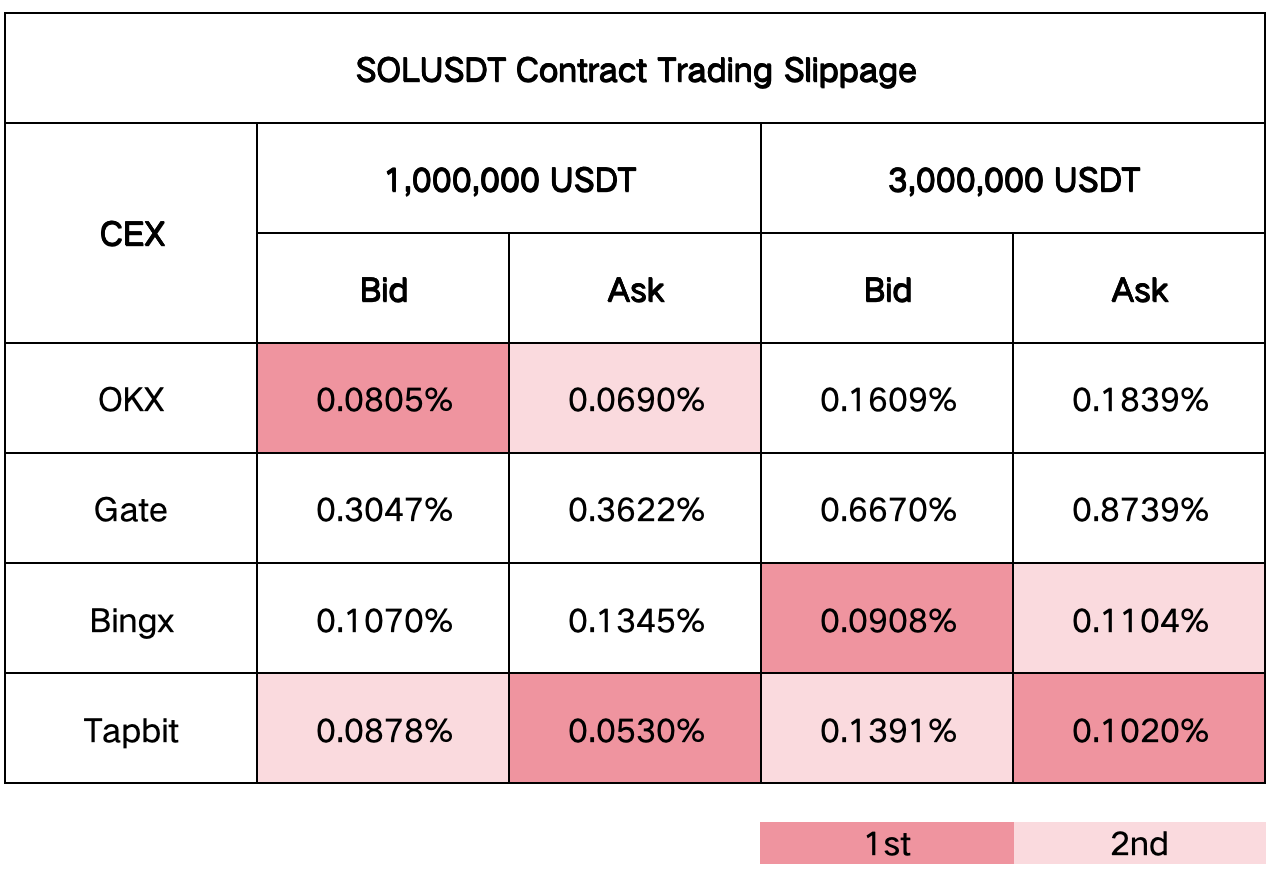

2. SOL Contract Slippage and Spread:

At smaller trading volumes(1,000,000 USDT), OKX and Tapbit stand out, but at larger volumes(3,000,000 USDT), Bingx and Tapbit show advantages in slippage. Overall, if you’re a high-volume contract trader, trading on Tapbit offers the optimal trading experience.

VI.Comprehensive Assessment

For ETHUSDT contract trading, Tapbit and OKX stand out due to their low slippage and deep liquidity, making them preferred platforms for large transactions. As shown in the comparison, traders looking to minimize slippage-related costs while ensuring deep market access should prioritize these platforms.

When trading altcoins like SOLUSDT, Bingx, and Tapbit demonstrate good market liquidity and low slippage under various trading volumes and depth conditions, making them suitable for high-frequency and large-volume traders.OKX performs better slippage at smaller trading volumes, making it ideal for small-volume traders.