This article aims to conduct a comparative analysis of liquidity conditions across major trading platforms. Liquidity is a crucial indicator for evaluating platform quality, directly impacting users’ trading experience and costs. Through analyzing order book depth, bid-ask spreads, and slippage across these platforms, we can understand their performance in trading operations.

II. Research Methodology

– Comparison Targets: Bitget, BINGX, and Tapbit

– Comparison Subjects: BTC and randomly selected cryptocurrency of the week: SOL

– Key Liquidity Indicators:

– Order Book Depth

– Bid-Ask Spread

– Slippage

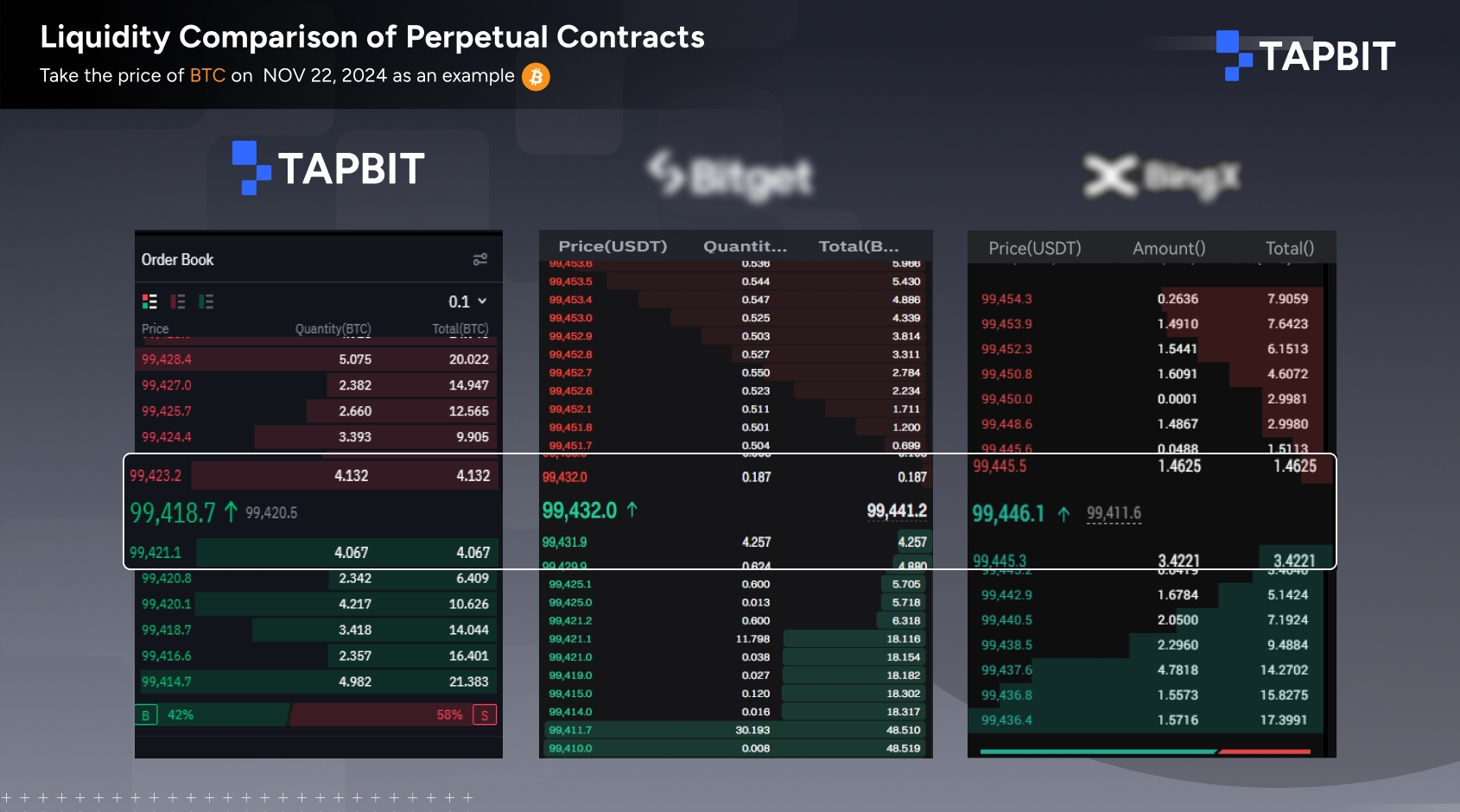

III. BTC Perpetual Contract Liquidity Analysis

The following shows the trading depth, bid-ask spread, and slippage conditions for BTCUSDT contracts across major platforms:

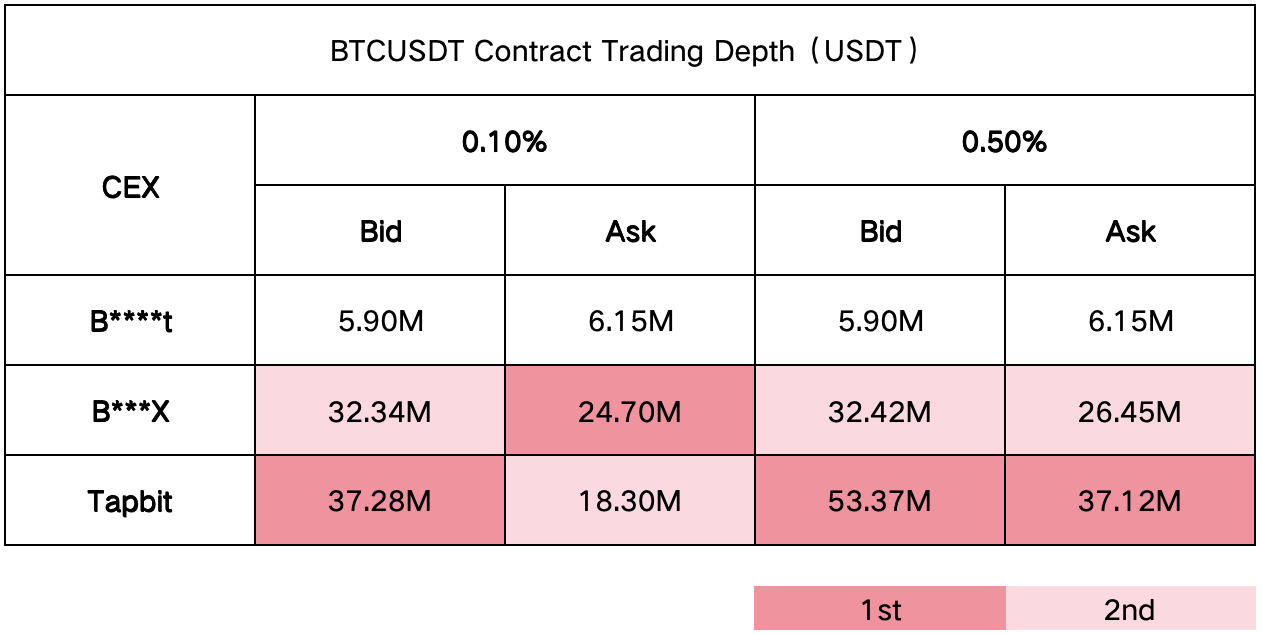

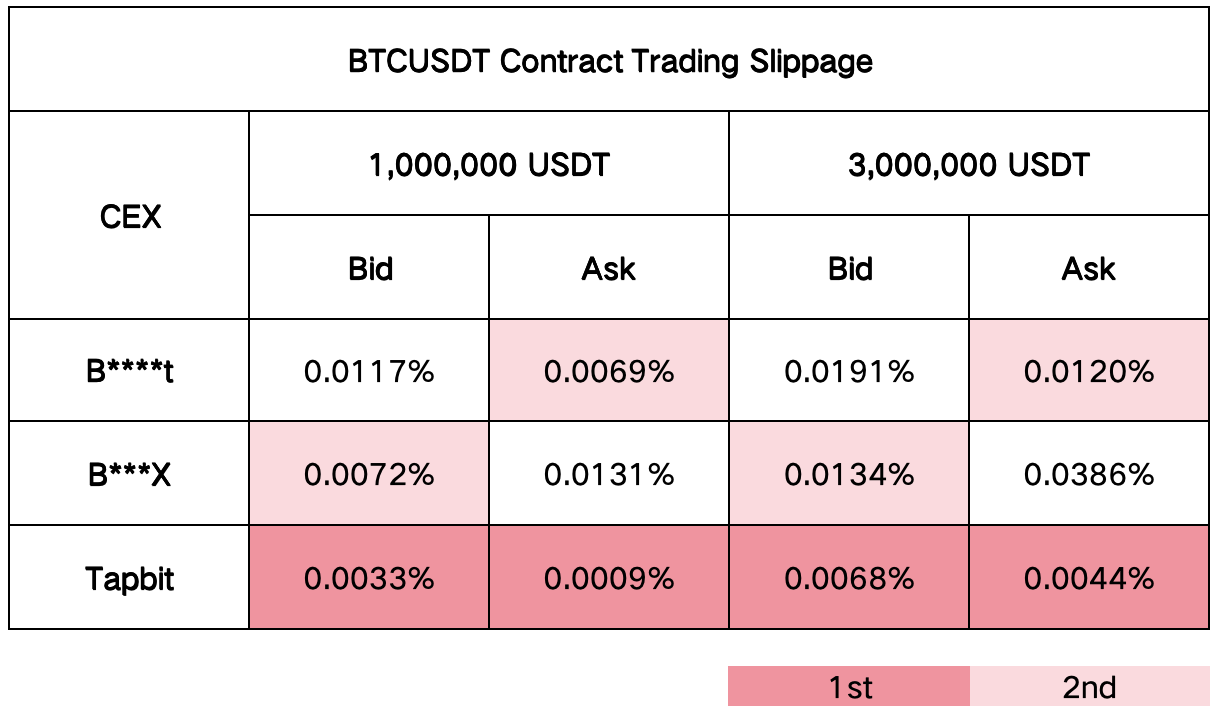

1. BTCUSDT Contract Trading Depth (Unit: USDT):

Trading Depth Analysis:

Tapbit demonstrates clear advantages in BTC contract trading depth. With its substantial liquidity pool, the platform efficiently handles large-volume orders, ensuring seamless trade execution. Though B*X holds the second position, its market depth falls short when it comes to accommodating ultra-large transactions. Meanwhile, Bt’s more modest depth makes it better suited for smaller-scale traders.

2. BTC Contract Trading Slippage:

Tapbit shows the most stable in slippage, which providing precise order execution even during high market volatility. While B*X holds second place, it faces challenges with slippage on larger orders. Bt exhibits more significant slippage variations, which may result in additional trading costs for traders.

Summary:

For BTCUSDT contracts, Tapbit stands out as the go-to platform for those traders who requiring high liquidity, powered by exceptional market depth, competitive spreads and slippage control. B*X is suitable for small and medium-sized investors, while Bt is more appropriate for standard trading requirements.

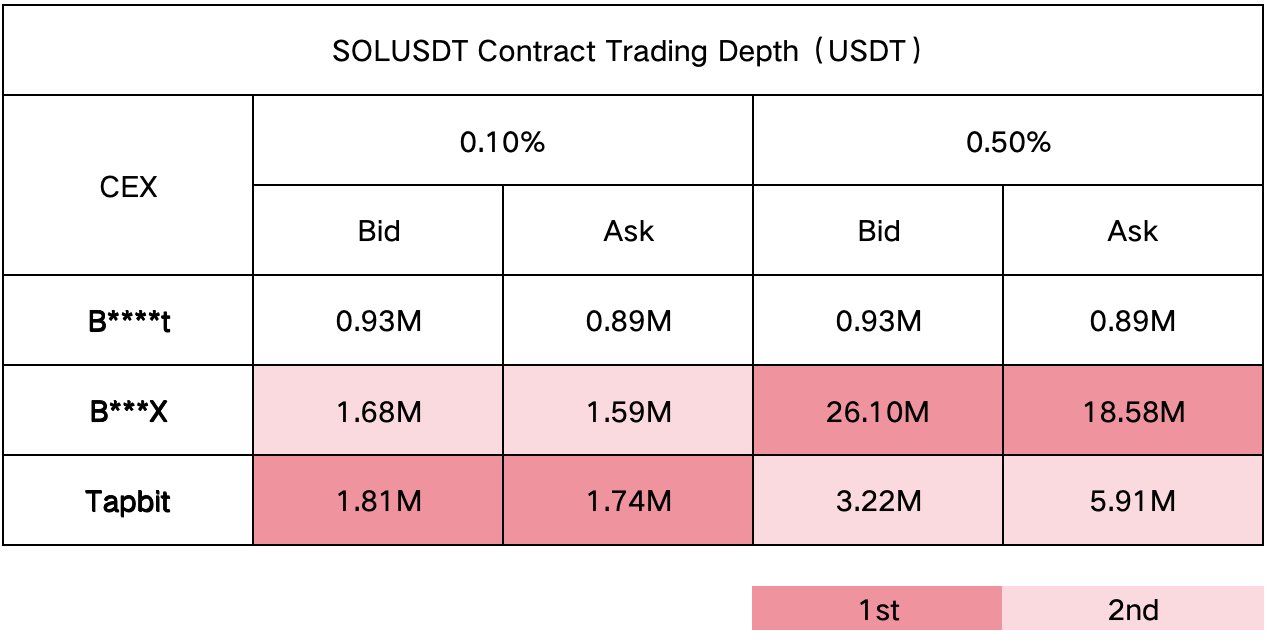

IV. SOL Perpetual Contract Liquidity Analysis

For SOLUSDT contracts, the platforms show the following key characteristics:

1. SOLUSDT Contract Trading Depth:

In SOLUSDT contracts trading, Tapbit still demonstrates superior liquidity. The platform’s exceptional capacity to handle large-volume orders sets it apart from competitors, making it the ideal choice for traders requiring efficient execution. B*X shows potential in depth but falls slightly short in complex trading environments. Bt’s depth is the most limited, primarily serving small-transaction needs.

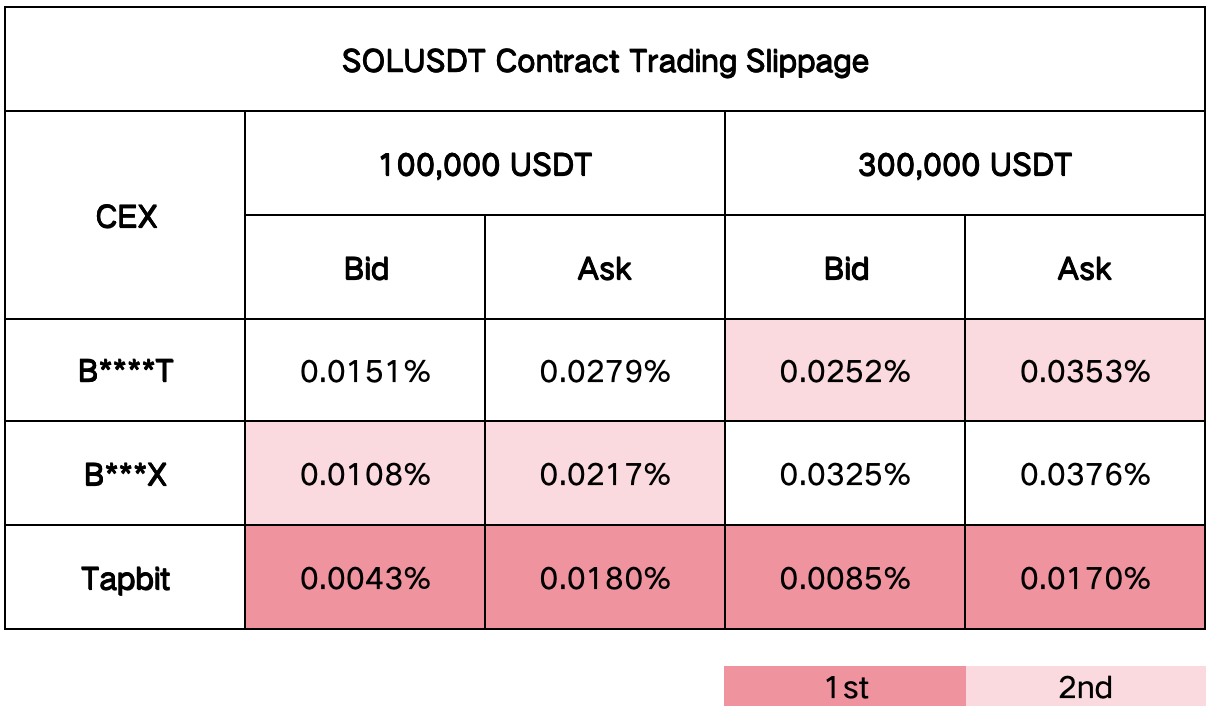

2. SOL Contract Trading Slippage:

Tapbit maintains consistent slippage control, providing precise execution even in large transactions. B*X follows with respectable slippage management, suitable for general investors. Bt shows the most unstable slippage performance, potentially increasing trading risks during low liquidity periods.

Summary:

For SOLUSDT contracts trading, Tapbit maintains its excellent performance of BTCUSDT contracts, positioning itself as the premier choice for high-volume and frequent traders. B*X serves as a secondary option suitable for small and medium-scale investors, while Bt is more appropriate for small-volume and low-frequency traders.

VI. Comprehensive Assessment

Through analysis of both BTCUSDT and SOLUSDT contracts trading, Tapbit demonstrates market leadership through higher liquidity, lower trading costs, and minimal slippage. B*X performs well under specific conditions, making it a reasonable choice for medium-scale investors. Bt, with its stability and simplicity, is suitable for newbies or small-volume traders.