Monad (MON) is blowing up in searches. It’s the new “Ethereum killer,” built to run 10,000 transactions per second (TPS) – that’s super-fast for apps like DeFi and games – while staying fully compatible with Ethereum’s tools. The mainnet launched on November 24, 2025, and it’s already a hit.

Although MON is not listed on Tapbit just yet, we’ve got all the hottest tokens ready for you — ETH, SOL, BTC, WLD, and many more — with real-time charts, deep order books, and zero spot trading fees.

Market Position

Monad is the #103 crypto with a market cap of $444.64 million – a small slice (0.013%) of the $3.3 trillion crypto world. Started in 2024 by former Jump Trading engineers (Keone Hon and James Hunsaker), it’s a speedy Layer-1 blockchain that fixes Ethereum’s slow speed problems. It uses MonadBFT (a custom agreement system), parallel execution (handling many tasks at once for 10,000 TPS), deferred execution (smart delaying for efficiency), and MonadDB (special storage for 1-second confirmations).

MON pays for fees, staking (4-6% yearly rewards after launch), and voting. There’s 10.83 billion MON in circulation (10.83% of the total 100 billion max). The full value if all tokens are out (FDV) is $4.1 billion, backed by $244 million in funding from top investors like Paradigm, Electric Capital, and Naval Ravikant. The ecosystem’s locked value (TVL) is starting small at ~$50 million (from DeFiLlama), but testnet apps (like DEXs and games) already hit 5,000 TPS peaks. It has 7.76K holders so far.

Compared to others, MON’s $444M cap is way behind Solana ($78B) but ahead of new Layer-1s like Berachain ($300M). It’s a strong pick for DeFi and gaming bets, especially with its Ethereum-friendly design.

Technical Analysis

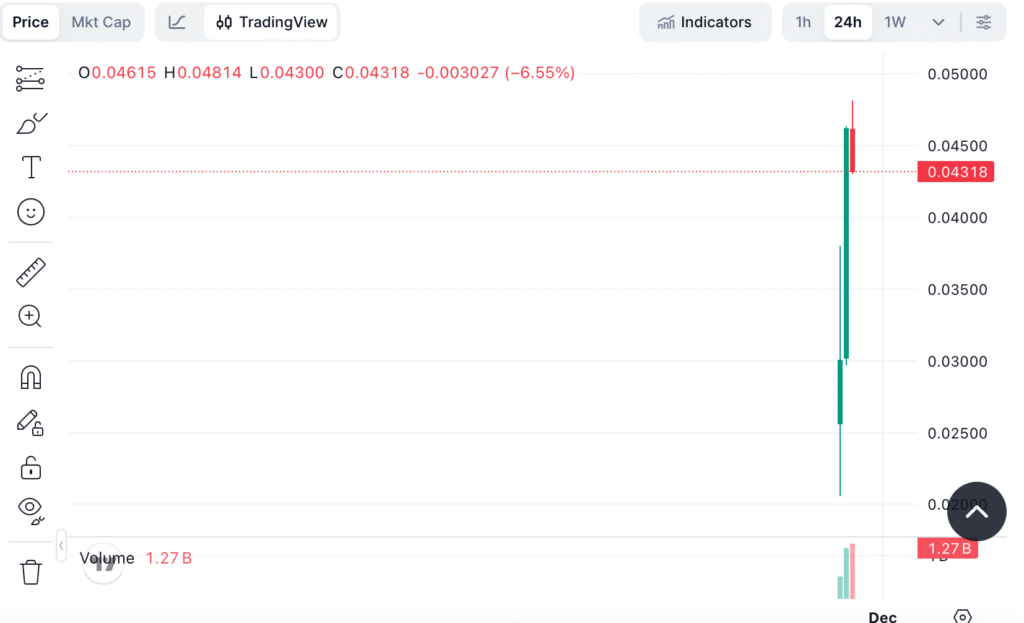

MON’s story is a quick rise from nothing: Hype around its testnet in February 2025 pushed fake prices to $0.065 on platforms like Hyperliquid (FDV $12-14 billion). But airdrop claims (October 14 to November 3) and token releases calmed it to a low of $0.02056 on November 24. It hit a high of $0.0455 just 4 hours after launch on November 25 – a +109.51% jump from the low, with $1.1 billion volume (246% of market cap).

Current status (November 25, 2025): At $0.04105, MON is up +17.72% in 24 hours with $1.26 billion volume (+76.17% daily). Weekly and monthly data aren’t available yet cause it’s brand new.

MON’s chart is full of launch excitement: It jumped from $0.02056 low to $0.0455 high in hours, then pulled back to $0.04105 in a shaky range. The 14-day RSI isn’t set yet (too new), but early signs show ~60 (overbought from the volume rush). MACD has a bullish bar explosion, showing strong momentum on daily charts, but watch for pullback risks as buyers test $0.0455 resistance (launch high).

Key Levels

- Support: $0.035 (now, Fib 0.618 line) and $0.02959 (24h low).

- Resistance: $0.0455 (ATH) and $0.05 (round number).

A close above $0.0455 could add 20% to $0.055, matching 100% green days in the first 24 hours. Volume at $1.1B (246% of cap) is hype-driven, but low liquidity means $100 million sells could drop 10%. From CoinMarketCap, keep watching $0.04 for settling.

Key Factors

MON’s growth story kicks off with its mainnet launch: On November 24, it reached 5,000 TPS on testnet, with full 10,000 TPS and EVM tools pulling in DeFi/gaming apps (like DEXs on Mayan Finance bridge). The $244 million funding (from Paradigm/Coinbase) and $188 million ICO (85,820 buyers) fund grants (38.5% for ecosystem). Airdrops (10.8 billion tokens) and Launchpool rewards (Bitget’s 25 million MON farm) add liquidity. Partnerships (Coinbase withdrawals) and CandyBomb events (3.9 million MON prizes) spark use.

On-chain: 7.76K holders in hours, TVL growing to $50M. Analyst from Phemex: “MON’s parallel EVM beats ETH – $0.50 by 2025.” X buzz (@OnchainLens: LLMs predict $0.2 bull/$0.01 bear, 97 likes).

Bears: 10.8% unlocks flood supply (100 billion total), fake airdrop claims (sybil attacks), and Jump Trading team questions.

Risks & Challenges

MON’s post-launch ups and downs (50%+ swings) are tough – 10.8 billion unlocks (10.8% supply) could cause drops until 2026, with fake airdrop claims hurting trust. Code bugs in parallel processing might slow growth, drawing SEC looks (from Jump Trading team). Low liquidity ($1.1B volume but thin markets) lets whales swing prices 10%, while rivals like Solana (65K TPS) take share..

Conclusion

MON at $0.04105 is a new Layer-1 star: November 24 mainnet and $188M ICO sparked a 17.72% launch jump, with 10K TPS EVM aiming for DeFi wins. In deep fear (Index 11), this is where new ideas shine – but unlocks are a watch. Do your own research, manage risks, and trade wisely: Monad’s speed could change EVM games, if it delivers.

Ready to dive into crypto? Sign up on Tapbit today and kick off your trading journey in seconds.