Liquidity is one of the core competitive advantages for cryptocurrency exchanges. High liquidity not only offers lower trading costs for investors but also ensures efficient execution of large orders and stable market prices.

This report analyzes the liquidity performance of three major trading platforms — B*T, B*X, and Tapbit—in XRP USDT and ADAUSDT perpetual trading pairs. Using key metrics such as order book depth, bid-ask spread, and slippage, it explores the differences in trading experience across these platforms, providing investors with insights to make more informed choices.

Research Methodology This research examines the XRPUSDT and ADAUSDT trading pairs on the B*T, B*X, and Tapbit platforms. Key liquidity metrics include:

- Order Book Depth: Measures the market’s capacity to absorb large orders.

- Bid-Ask Spread: Reflects transaction costs.

- Slippage: Indicates price deviations during the execution of large orders.

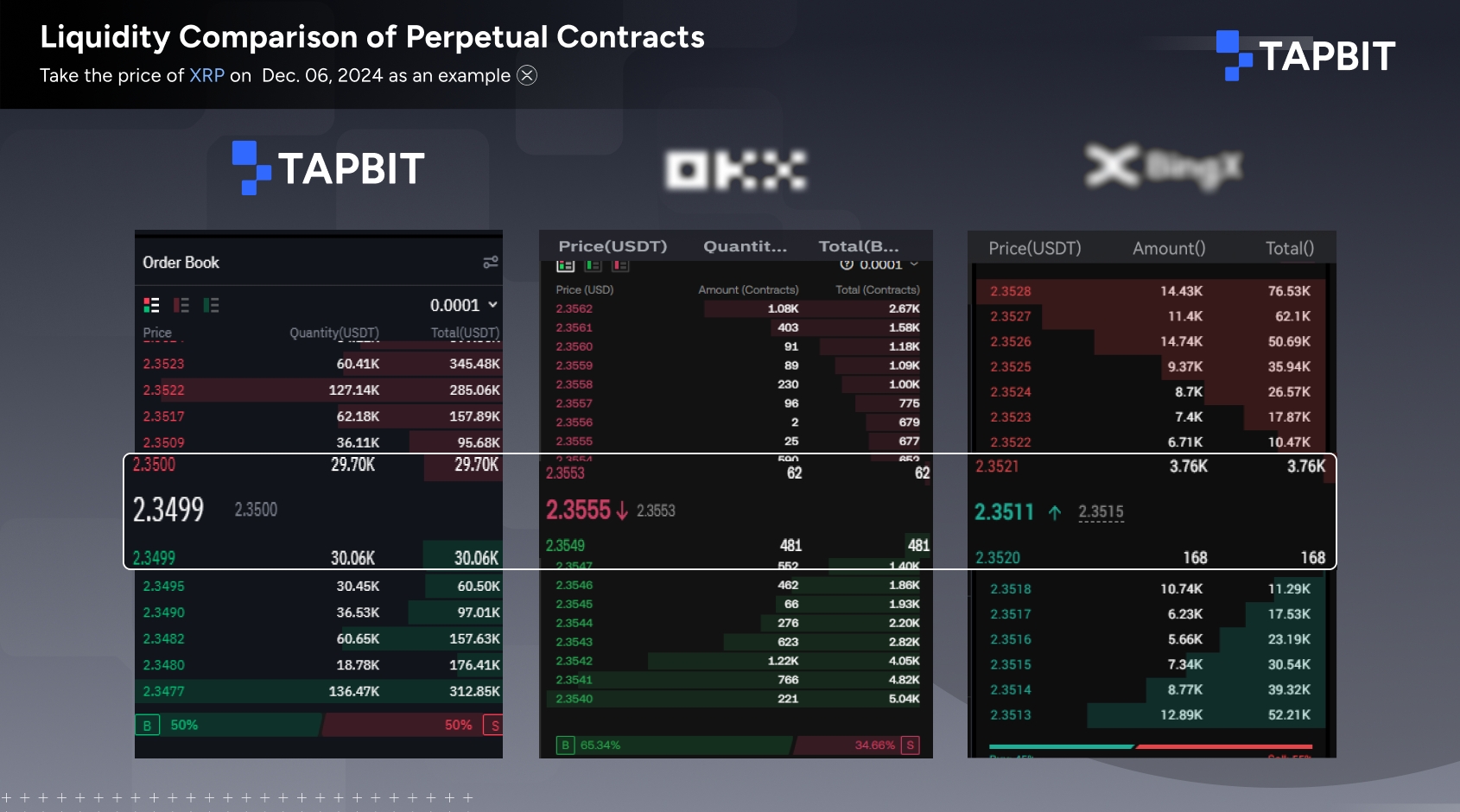

Liquidity Analysis of XRP Perpetual Contracts

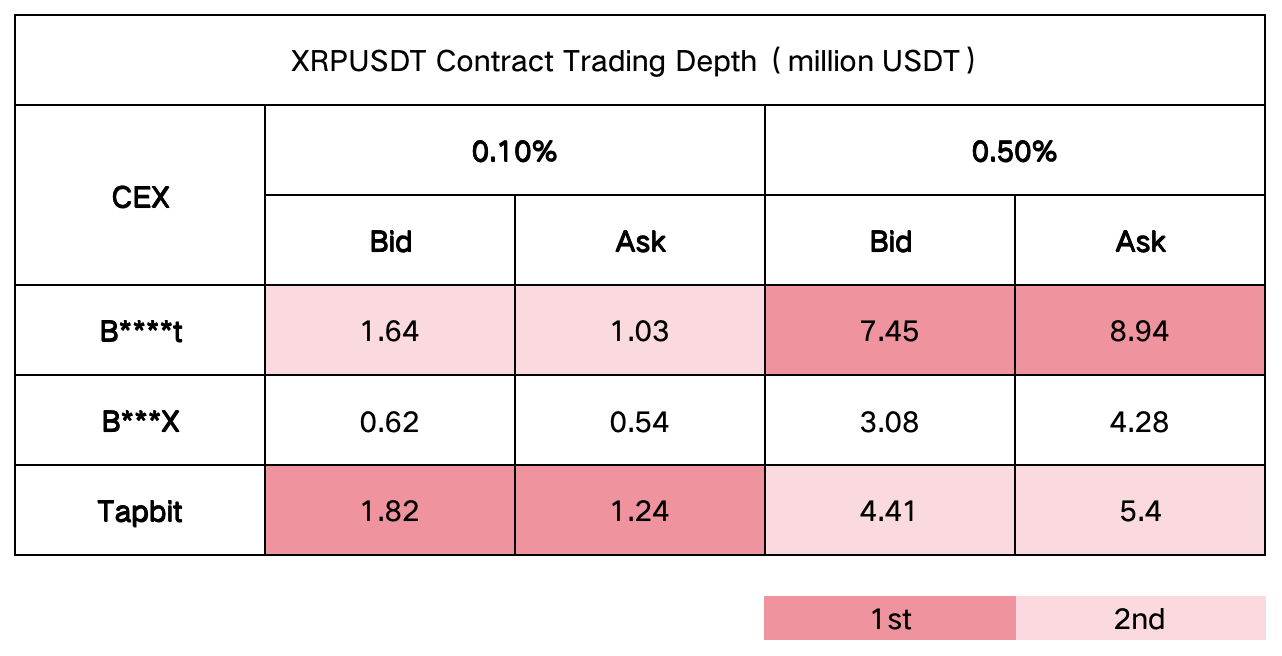

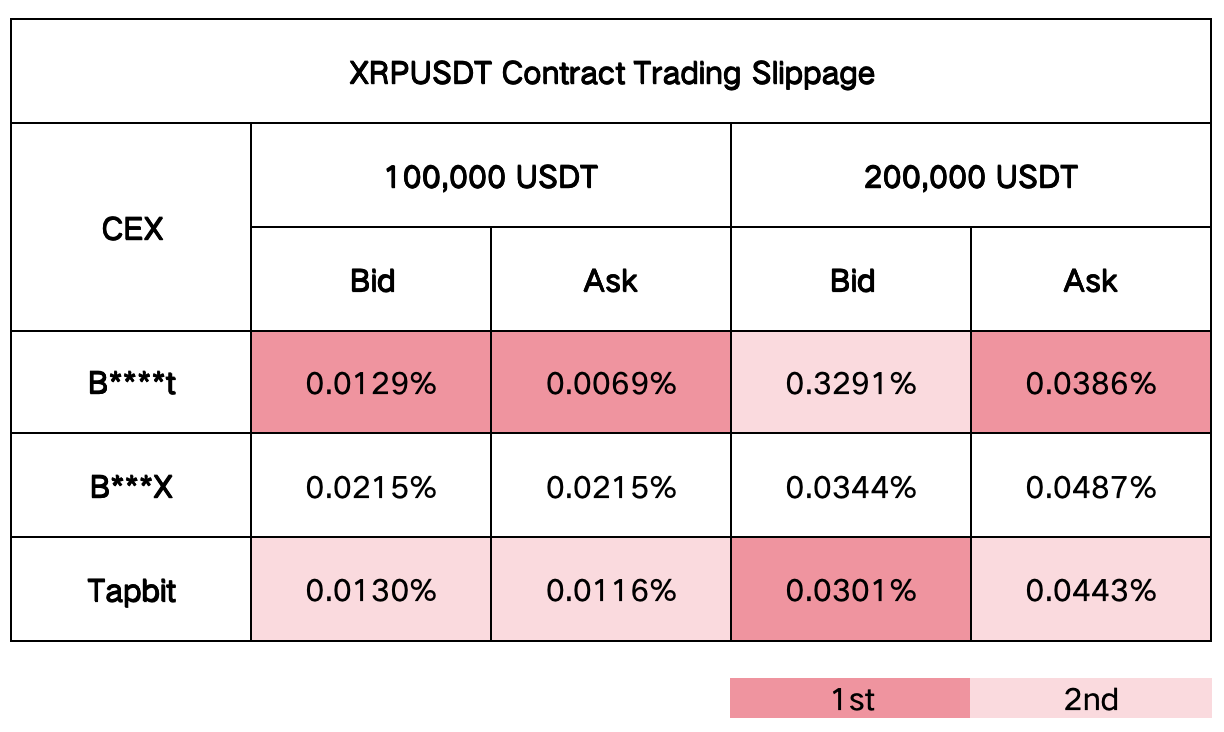

- Order Book Depth

For XRPUSDT perpetual contracts, Tapbit demonstrated the best performance at a 0.10% depth range, with its bid and ask order levels exceeding those of B*X and closely matching B*T. At a 0.50% depth range, B*T took the lead, showcasing its robust market capacity. In contrast, B*X lagged in both depth ranges, indicating relatively limited liquidity.

Tapbit offered the most competitive bid-ask spreads, minimizing trading costs for users. B*T followed, while B*X exhibited wider spreads, which could increase costs for frequent traders. Tapbit maintained the most stable slippage rates in XRP contracts, especially for medium-sized transactions. B*T showed slightly higher slippage, particularly for large orders, while B*X’s higher slippage made it less appealing for high-frequency or large-volume trading.

Summary Tapbit is ideal for medium-sized traders due to its balanced performance across metrics. B*T is better suited for large-scale orders due to its superior depth, whereas B*X, with its limited liquidity, is more suitable for small-scale trades or beginner investors.

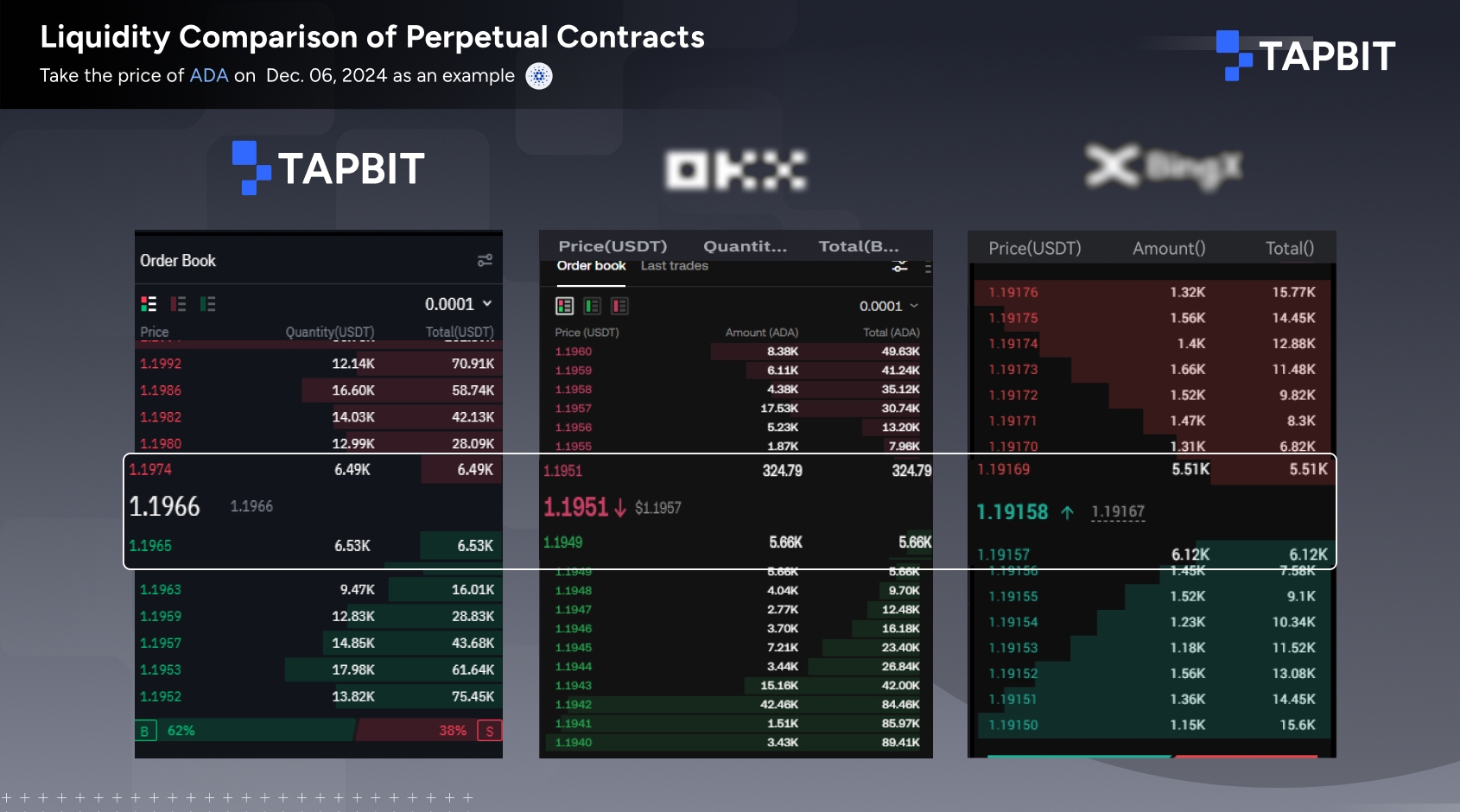

Liquidity Analysis of ADAUSDT Perpetual Contracts

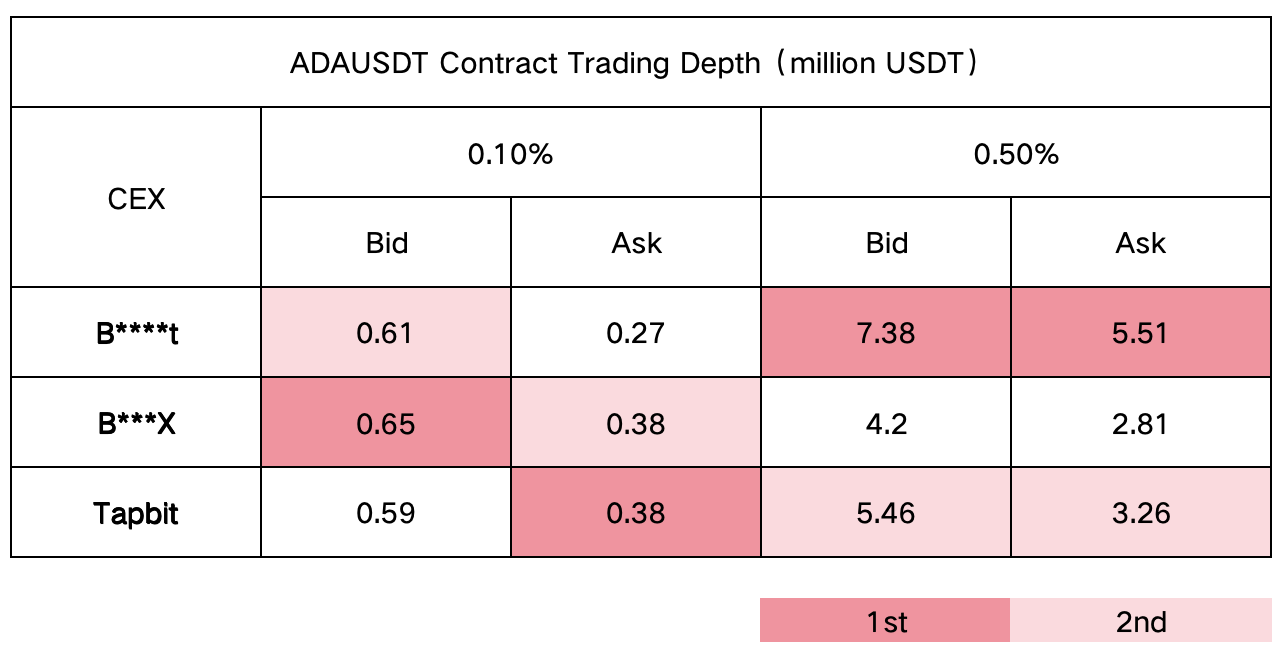

- Order Book Depth

In ADAUSDT contracts, B*T demonstrated the strongest order book depth, particularly in high-depth scenarios, making it the leader in absorbing large orders. Tapbit and B*X showed comparable depth levels, although both lagged behind B*T in supporting large-scale transactions.

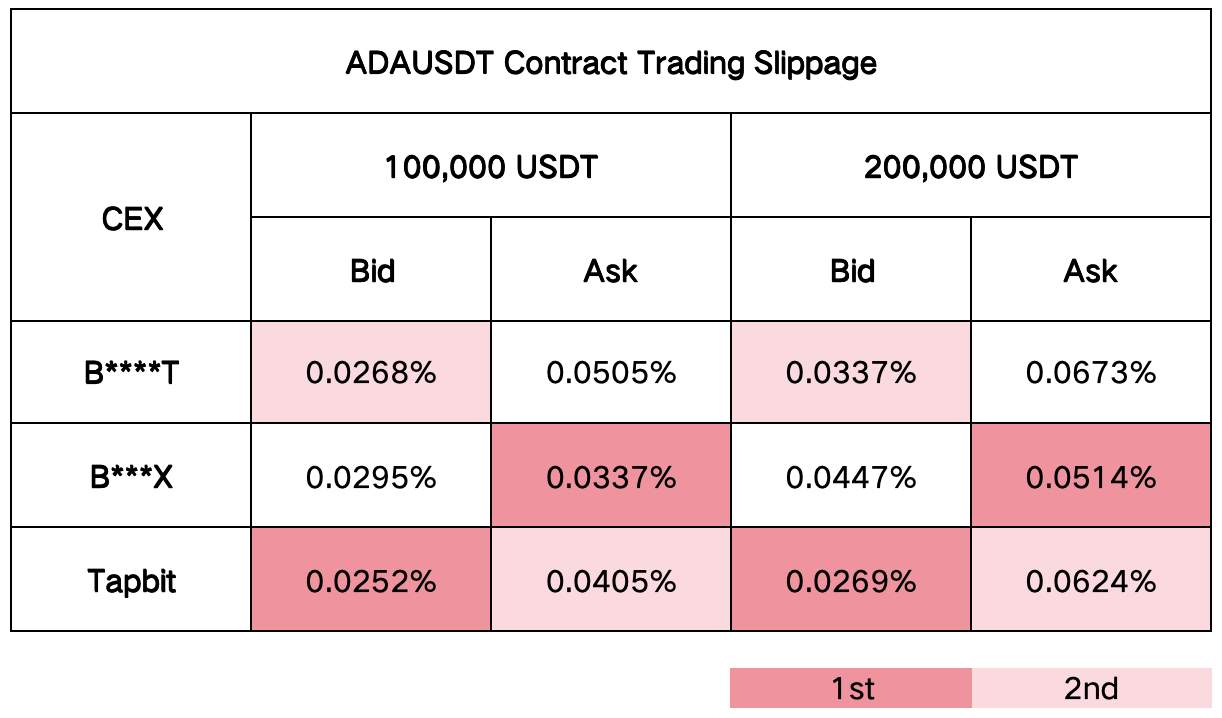

Tapbit continued to perform well with lower bid-ask spreads, reducing transaction costs. B*T followed, while B*X’s wider spreads posed challenges for cost-sensitive traders. Tapbit maintained its advantage in slippage for ADA contracts, offering consistent performance across small and medium transaction sizes. B*T’s slippage was similar but showed more variability with large orders. B*X had the highest slippage, potentially impacting users requiring precise execution.

Summary For ADAUSDT perpetual trading pair, B*T is the preferred choice for investors requiring deep liquidity for large transactions, while Tapbit appeals to small- and medium-scale traders with its cost efficiency and stability. B*X caters more to small-scale or short-term speculative trading needs.

Comprehensive Evaluation Overall, B*T excels in liquidity depth, especially for handling large orders. Tapbit, with its narrower bid-ask spreads and lower slippage, is the preferred platform for cost-conscious users. Although B*X underperforms in most metrics, it remains adequate for small-scale trades and new users seeking simplicity.