Liquidity is one of the core competitive advantages of cryptocurrency exchanges. High liquidity not only provides investors with lower trading costs but also ensures efficient execution of large orders and market price stability. This article analyzes the liquidity performance of three major trading platforms—B*T, B*X, and Tapbit—in BTC and XRP perpetual contracts, examining differences in trading experience across three dimensions: order book depth, bid-ask spread, and slippage, to help investors make more informed choices.

II. Research Methodology

– Comparison Objects: B*T, B*X, and Tapbit

– Comparison Targets: BTC and XRP

– Key Liquidity Indicators:

– Order Book Depth

– Bid-Ask Spread

– Slippage

III. BTC Perpetual Contract Liquidity Analysis

BTCUSDT contract trading depth, spread, and slippage across platforms are as follows:

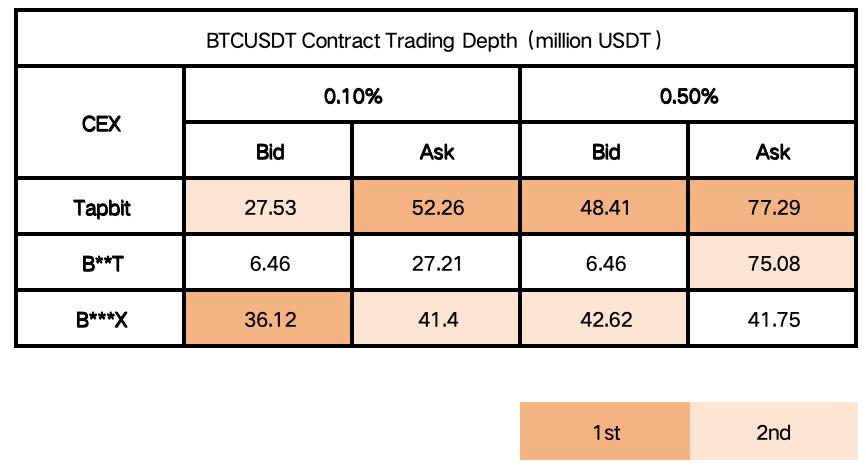

1. BTCUSDT Contract Trading Depth (Unit: USDT):

Trading Depth Analysis:

Tapbit leads with significant advantages in BTCUSDT perpetual contract order book depth, particularly notable within the 0.50% depth range. B*X shows stable performance with moderate depth, while B*T’s depth is relatively lower, with slightly inferior overall liquidity. Tapbit is suitable for large transactions, while B*X is another quality option.

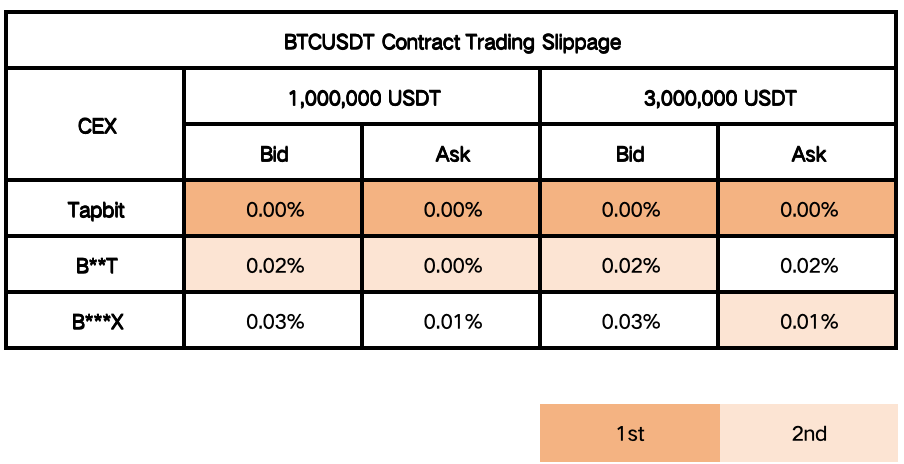

2. BTC Contract Trading Slippage:

Slippage Analysis:

Slippage analysis shows that Tapbit maintains the lowest slippage, maintaining cost control advantages even in large transactions. B*T and B*X have higher slippage, particularly B*X showing notable slippage fluctuations at larger trading volumes. Tapbit’s low slippage performance makes it suitable for cost-sensitive users.

IV. XRP Perpetual Contract Liquidity Analysis

For XRPUSDT contracts, each platform shows the following highlights:

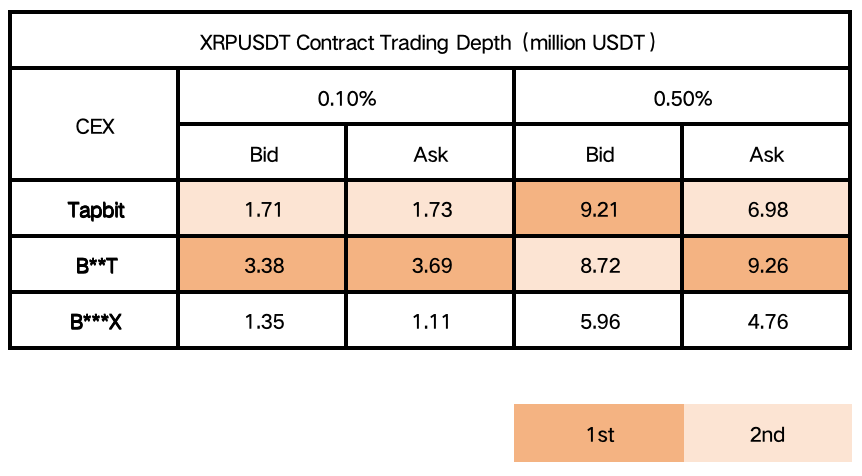

1. XRPUSDT Contract Trading Depth:

Trading Depth Analysis:

In XRPUSDT contract depth performance, Tapbit continues its strong performance, slightly outperforming B*X, while B*T notably lags. Tapbit maintains good liquidity support in the market. Tapbit shows excellent depth performance suitable for medium-sized order trading, while B*X is suitable for investors with higher depth requirements.

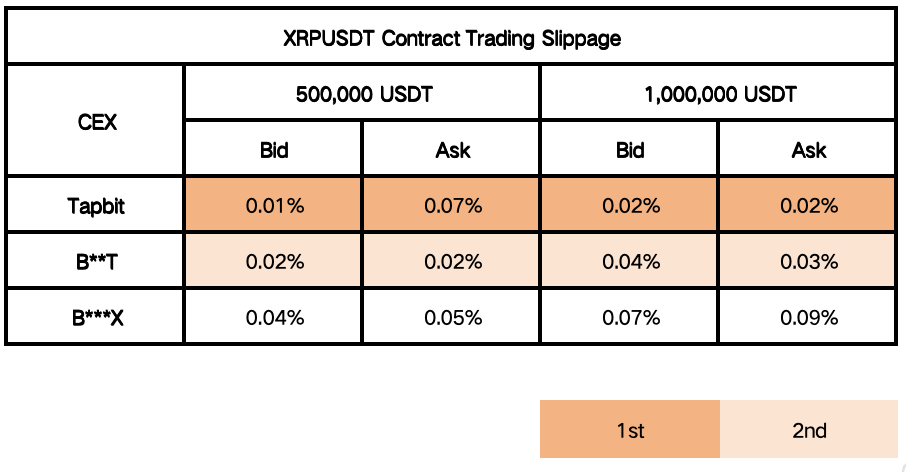

2. XRP Contract Trading Slippage:

Slippage Analysis:

Regarding slippage, Tapbit maintains its low-level slippage advantage, showing stable performance in both medium and large transactions. B*T and B*X have higher slippage, particularly B*X showing notably high slippage in large transactions.

V. Copy Trading and Liquidity Synergy Effects

We observe Tapbit’s excellent performance in BTC and XRP perpetual contract liquidity. This high-quality liquidity environment not only provides favorable trading conditions for regular traders but also creates significant advantages for the platform’s Copy Trading system. This is clearly evidenced by the latest weekly trader rankings:

1. Top Traders’ Outstanding Performance

Benefiting from the platform’s quality liquidity support, Tapbit’s top traders have shown remarkable profitability:

– Perfect Zone fully utilizing the platform’s low slippage advantage, achieved notable results:

– Weekly ROE reaching 214.80%, largely attributed to the platform’s stable liquidity support

– 79.84% high win rate, backed by the platform’s excellent order execution capability

– Follower profits of 91,688.00 USDT, demonstrating the strategy’s replicability in large-scale following

– Second Place Trader similarly demonstrated full utilization of platform depth:

– Maintaining 214.80% weekly ROE

– Follower profits reaching 60,778.00 USDT, indicating stable execution efficiency even with large-scale copy trading

– 코인쿠키(Coin Cookie) achieved steady returns through the platform’s low-cost advantage:

– 109.50% weekly ROE with 68.42% win rate

– Follower profits of 22,085.00 USDT

2. Positive Cycle between Liquidity and Copy Trading

Tapbit’s quality liquidity environment provides a solid foundation for the Copy Trading system:

– Low slippage and sufficient order book depth allow traders to better execute strategies

– Stable trading environment ensures followers can obtain similar execution prices as master traders

– The platform’s efficient order execution system maintains good profitability even in large-scale copy trading

These data clearly demonstrate that Tapbit’s excellent liquidity not only creates a quality trading environment for individual traders but also provides a successful foundation for the innovative Copy Trading model. Traders can fully utilize the platform’s liquidity advantages to achieve stable high returns while ensuring followers can share in the trading results.

VI. Comprehensive Assessment

Tapbit stands out in both BTC and XRP perpetual contracts with low slippage and high liquidity depth, making it the best choice for investors seeking stability and low costs. While B*X’s depth advantage makes it suitable for users requiring large order execution capability, BT shows relatively weaker overall performance but still maintains competitiveness in certain scenarios.