This document aims to provide a comparative analysis of the liquidity conditions on major trading platforms, namely OKX, Kucoin, Gate, and Tapbit. Liquidity is a critical indicator of a trading platform’s quality, as it directly impacts the user’s trading experience and costs. By analyzing the order book depth, bid-ask spread, and slippage on these platforms, we can better understand their performance in trading scenarios.

II. Research Methodology

Comparison Targets: OKX, Kucoin, Gate, and Tapbit

Comparison Pairs: ETH and AVAX, selected randomly for this week

– Primary Liquidity Indicators:

– Order Book Depth

– Bid-Ask Spread

– Slippage

III. Liquidity Analysis for ETH Perpetual Contracts

– ETHUSDT Contract Trading Depth (in USDT):

Tapbit leads in overall trading depth, with bid and ask depths ranging from 12-21M USDT at the 0.10% and 0.50% tiers. OKX follows closely, showing solid performance at the 0.50% tier with bid and ask depths around 10-11M USDT. Gate.io performs well at the 0.50% level, while Kucoin has relatively lower depth and greater disparity between bid and ask depths.

– ETH Contract Trading Slippage:

Tapbit not only shows the greatest depth but also the smallest slippage (around 0.014%-0.019%) according to API monitoring data, demonstrating the highest liquidity efficiency. OKX maintains low slippage (around 0.02%-0.024%) for 1 million USDT orders but shows increased slippage (0.043%-0.059%) for larger orders of 3 million USDT. Gate.io and Kucoin have moderate slippage performance.

IV. Liquidity Analysis for AVAX Perpetual Contracts

– AVAXUSDT Contract Trading Depth:

Tapbit and OKX lead in terms of depth, especially at the 0.50% tier, where Tapbit’s bid and ask depths reach 609K and 540K USDT, respectively, indicating strong liquidity. OKX also shows stable performance, while Gate.io and Kucoin display comparatively lower depth, with only 12K-15K USDT at the 0.10% tier and a slight improvement at the 0.50% level.

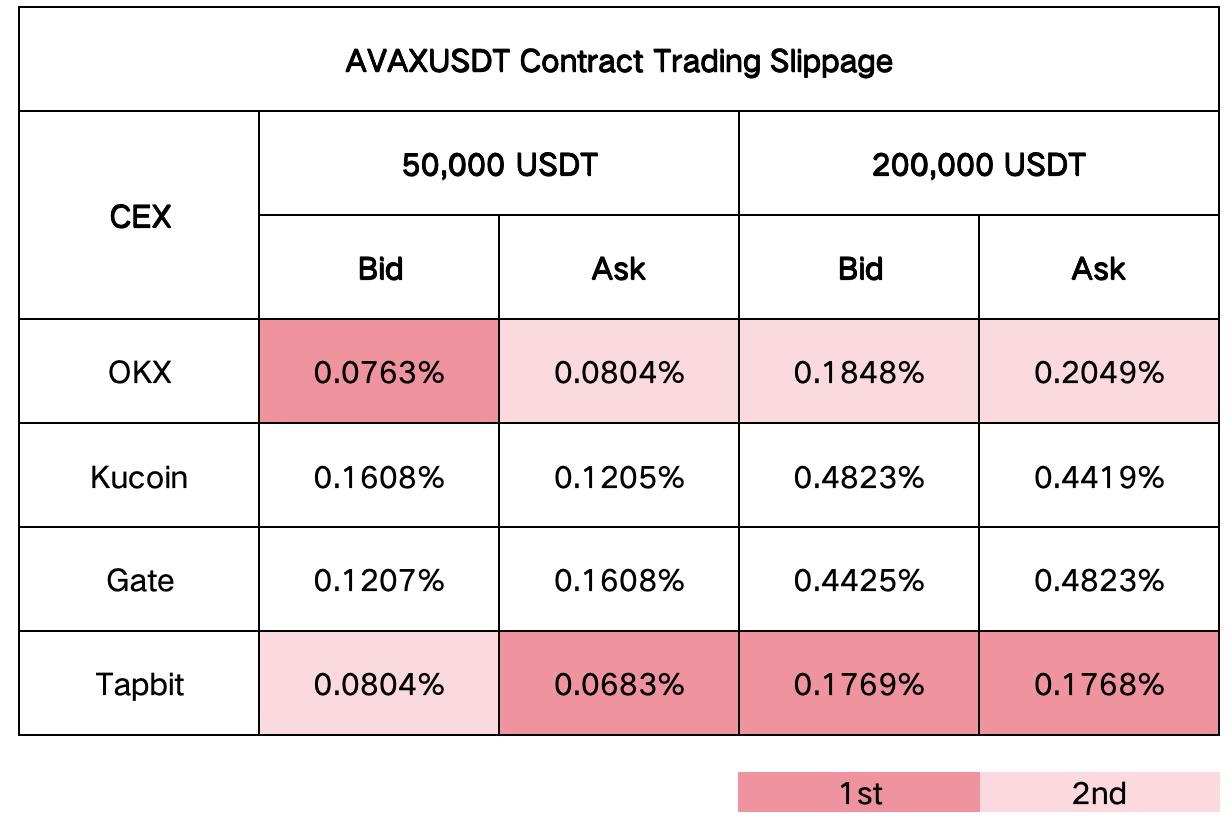

– AVAXDOGE Contract Trading Slippage:

OKX shows the lowest slippage (approximately 0.076%-0.080%) for small orders (50,000 USDT), while Tapbit performs best with larger orders (200,000 USDT), maintaining slippage around 0.177%, which reflects good price stability. Kucoin and Gate.io exhibit relatively high slippage, especially for larger orders, with slippage near 0.45%-0.48%. Overall, Tapbit and OKX perform best in AVAXUSDT contracts, meeting various trading needs. OKX is more suitable for small trades, while Tapbit offers advantages for larger trades.

VI. Comprehensive Assessment

– In terms of platform performance, Tapbit demonstrates significant advantages across both trading pairs, with the largest depth (12-21M USDT) and lowest slippage (about 0.014%-0.019%) for ETHUSDT, and leading position in AVAXUSDT (depth of 540K-609K USDT) with well-controlled slippage (about 0.177%). OKX also shows robust performance, especially in handling small to medium orders. Gate.io and Kucoin, however, perform comparatively weaker across both trading pairs, particularly in terms of liquidity and slippage control for AVAXUSDT.

VII. Insights for Investors

– Recommendations for Large-Order Traders: Large-order traders should prioritize Tapbit and OKX. Small and medium-sized traders may select specific exchanges based on the trading pair and amount. For large orders, it is advisable to use a split-execution strategy and avoid trading during low-liquidity periods or on platforms with weaker liquidity to achieve better execution results.

– Platform Selection Recommendation: For investors who prioritize liquidity and low-cost execution, Tapbit is undoubtedly the best choice, especially for large-scale transactions.