This analysis aims to compare the liquidity across major trading platforms. Liquidity serves as a crucial indicator of of the quality of trading platforms, directly influencing users’ trading experiences and costs. By analyzing the order book depth, bid-ask spread, and slippage across these platforms, we can understand their trading performance.

II. Research Methodology

– Comparison Subjects : Bitget, BINGX, and Tapbit

– Comparison Assets : BTC and randomly selected altcoin of the week: DOGE

– Key Liquidity Indicators :

– Order Book Depth

– Bid-Ask Spread

– Slippage

III. BTC Perpetual Contract Liquidity Analysis

Below are the trading depth, bid-ask spread, and slippage for BTCUSDT contracts pair across major platforms:

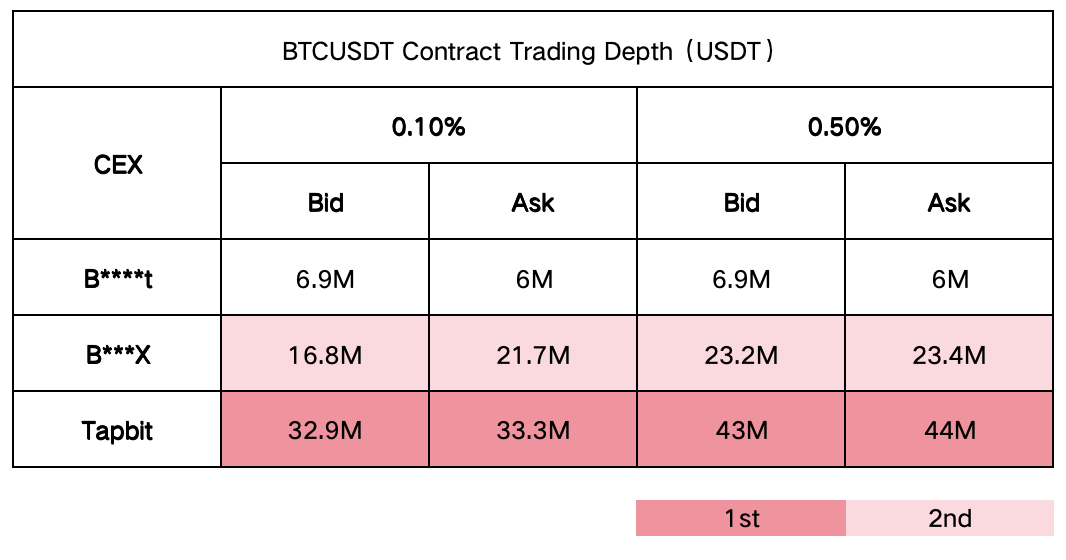

1. BTCUSDT Contract Trading Depth (Unit: USDT):

The trading depth data indicates that Tapbit demonstrates superior performance at both 0.10% and 0.50% depths, with significantly higher order volumes on both bid and ask sides compared to other platforms, making it particularly suitable for traders requiring high liquidity.

2. BTC Contract Trading Slippage :

Regarding low slippage, Tapbit demonstrates more stable order execution, maintaining relatively low slippage even with high-value orders.

Summary:

In the Bitcoin perpetual contract market, the three platforms show distinct differences. Tapbit exhibits exceptional performance, providing over 30M USDT in liquidity within the 0.1% price range, increasing to 43-44M USDT in the 0.5% range. If we compare the order book to a swimming pool, Tapbit undoubtedly offers the most suitable depth for large-scale traders (whales).

B *X follows closely, and while its total depth doesn’t match Tapbit, its 16.8M-21.7M USDT buy-sell depth adequately meets most institutional investors’ needs. In comparison, B * T’s 6-7M USDT depth appears relatively conservative, better suited for small to medium-scale traders.

Regarding slippage performance, the situation differs. When handling million-USDT level orders, Tapbit demonstrates remarkable execution efficiency, with buy-side slippage significantly outperforming competitors. This indicates well-functioning market-making systems capable of effectively processing large orders.

IV. DOGE Perpetual Contract Liquidity Analysis

For DOGEUSDT contracts, the platforms demonstrate the following key characteristics:

1. DOGEUSDT Contract Trading Depth :

For DOGE trading depth, Tapbit maintains higher levels, particularly demonstrating superior liquidity at 0.50% depth.

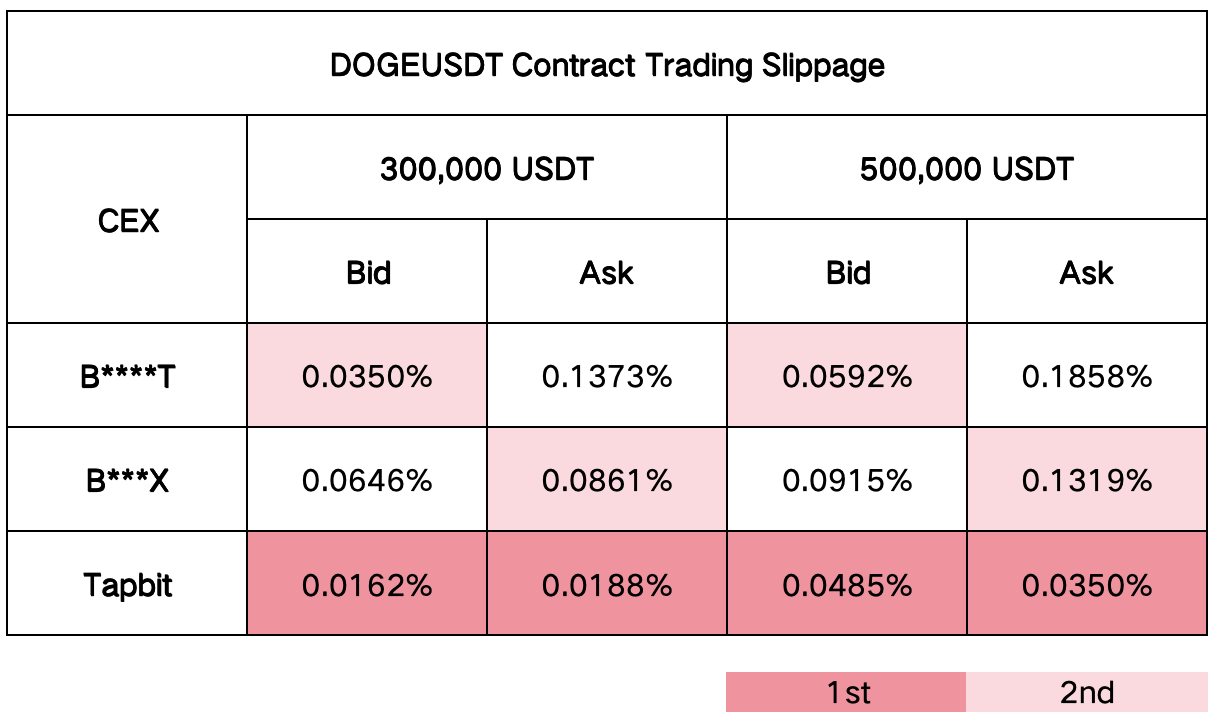

2. DOGE Contract Trading Slippage :

The slippage data indicates that Tapbit maintains lower slippage in smaller transactions, making it more attractive to users requiring precise execution.

Summary:

As a dynamic alternative asset in the market, DOGE’s perpetual contract liquidity merits attention. In this market, platforms exhibit varying characteristics:

Tapbit maintains its leading position, providing approximately 1M USDT bilateral depth within the 0.1% price range, demonstrating comprehensive strength beyond mainstream cryptocurrencies. However, a notable buy-sell imbalance appears in the 0.5% range, with bid depth reaching 4.38M USDT while ask depth remains at 1.19M USDT, potentially indicating bullish market sentiment.

B *X demonstrates good depth balance in the DOGE market. Although total volume falls short of Tapbit, the matching bid-ask depths represent an important advantage for investors seeking stable trading experiences.

VI. Comprehensive Assessment

Considering both BTC and DOGE perpetual contract liquidity indicators, Tapbit demonstrates outstanding performance in liquidity and trading costs, excelling in large order execution, low slippage, and narrow bid-ask spreads, making it the preferred choice for traders with high liquidity requirements. Additionally, B* t and B *X maintain certain advantages in small to medium-sized transactions.

VII. Implications for Investors

For large-scale traders with positions exceeding 1 million USDT, Tapbit is undoubtedly the primary choice. Its sufficient liquidity and relatively low slippage can effectively reduce trading costs. However, it is recommended to adopt an order splitting strategy, executing large orders in smaller portions to further optimize costs.

Medium-scale traders (100,000-1,000,000 USDT) have more options. Both Tapbit and B *X provide satisfactory liquidity support, allowing flexible choice based on specific trading pairs and current market conditions. Particular attention should be paid to bid-ask depth changes when trading secondary cryptocurrencies like DOGE.

Small-scale traders (below 100,000 USDT) have greater flexibility in their choices, as all three platforms provide adequate liquidity support. At this level, other factors can be prioritized, such as platform fee policies, user interface friendliness, and customer service quality.