I. Introduction

This document presents a comparison and analysis of the liquidity of major trading platforms, including Binance, Bitget, BingX, and Tapbit. Liquidity is a key indicator of a trading platform’s quality, as it significantly influences user experience and transaction costs. By evaluating the order book depth, bid-ask spread, and slippage of these platforms, we can effectively assess their performance in various trading scenarios.

II. Research Methodology

Comparative Objects: Binance, Bitget, BingX, Tapbit

Comparative Assets: BTC and a randomly selected cryptocurrency for the week, XRP

Key Liquidity Indicators:

- Order Book Depth

- Bid-Ask Spread

- Slippage

III. BTC Perpetual Liquidity Analysis

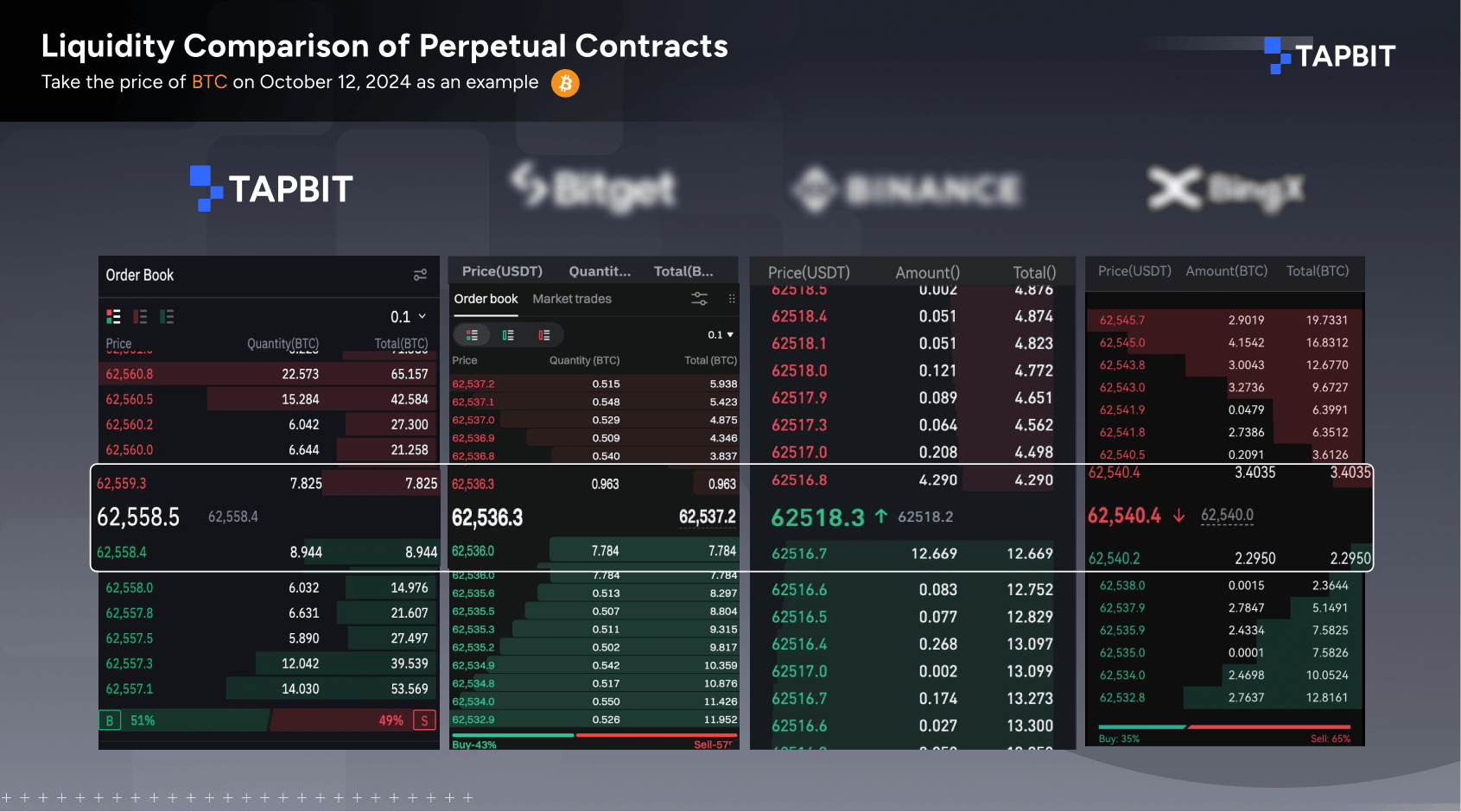

For the BTCUSDT contract, the trading depth, bid-ask spread, and slippage across major platforms are as follows:

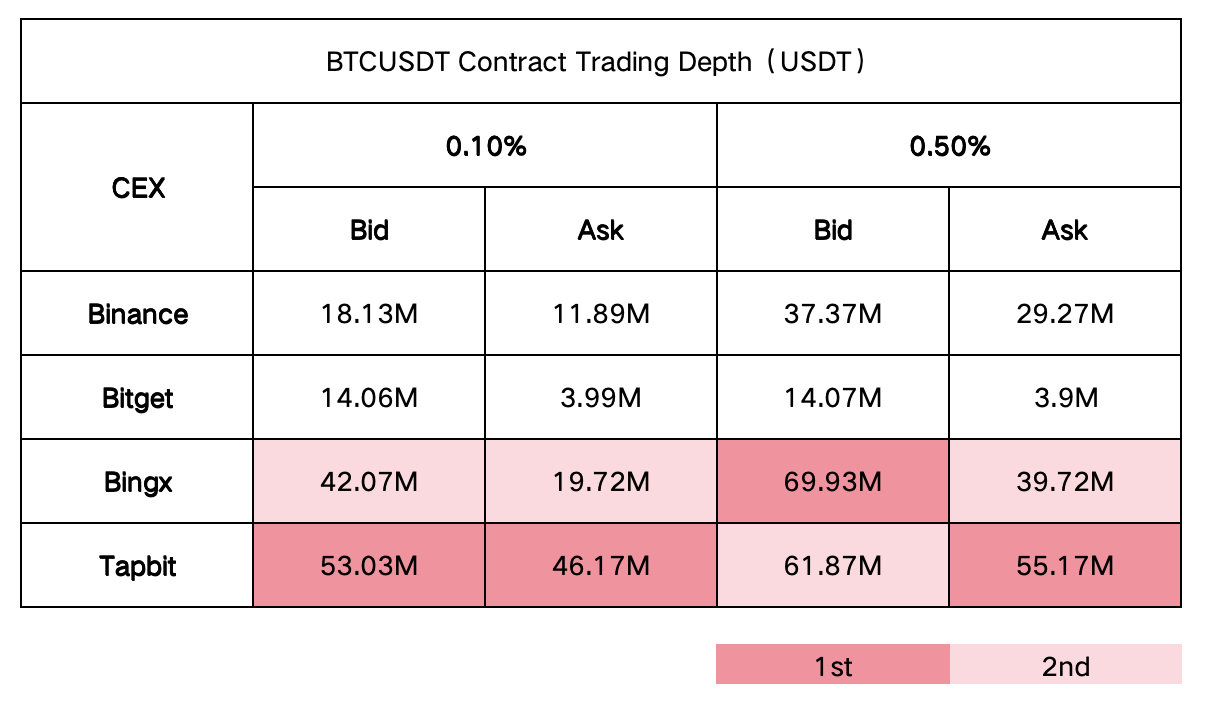

1. BTCUSDT Trading Depth(in USDT):

Tapbit and BingX demonstrate exceptional liquidity for BTCUSDT contracts, offering traders improved market depth and reduced slippage. For block traders, Tapbit may be the preferable option, as it can accommodate significant orders without noticeably affecting the market price. In contrast, Bitget’s comparatively lower market depth, particularly on the sell side, could result in substantial buy orders exerting upward pressure on prices.

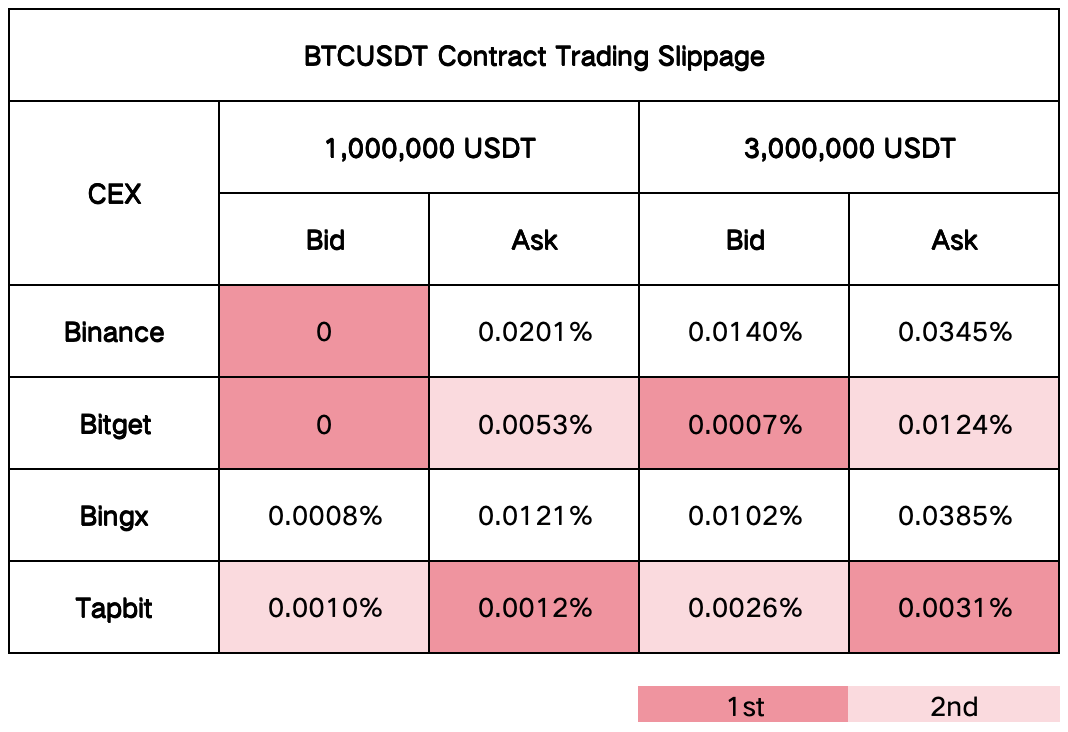

2. BTC Contract Slippage:

Based on the BTC contract slippage data, Tapbit exhibits exceptional performance across various transaction sizes. Whether transactions are executed at the scale of 1 million USDT or 3 million USDT, Tapbit consistently maintains the lowest and most stable slippage, demonstrating strong performance on both the buy and sell sides. This allows traders on the Tapbit platform to execute orders close to market prices, even for larger transactions, thereby minimizing costs. While Bitget also shows commendable performance in certain areas, particularly regarding slippage for buy orders at the 3 million USDT level, it generally falls short of Tapbit’s overall performance.

3. Summary of Platform Performance:

- Tapbit: Has the deepest order book and the lowest slippage.

- Bitget: Stable in small trades but shows significant slippage in large trades.

- BingX: Moderate performance overall, better than Binance but inferior to Tapbit.

IV. XRP Perpetual Contract Liquidity Analysis

For the XRPUSDT contract, the highlights of each platform’s performance are:

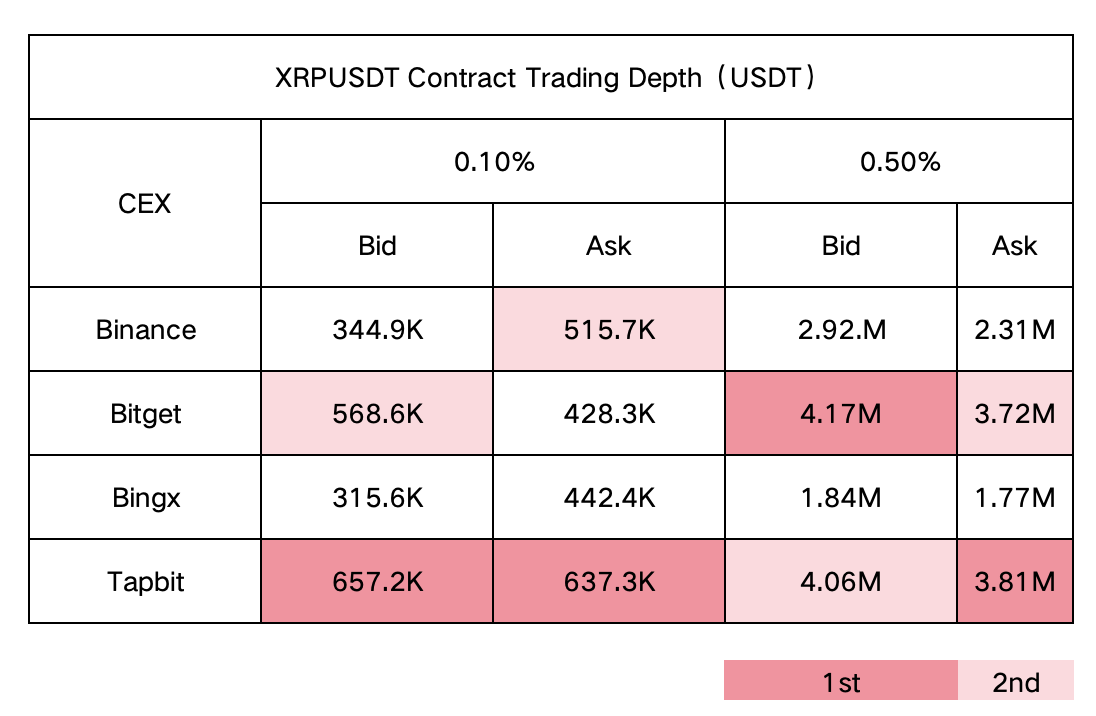

1. XRPUSDT Trading Depth:

Tapbit and Bitget show the best liquidity performance for XRPUSDT contracts, providing traders with better depth and potentially lower slippage. BingX needs improvement in this area to enhance its competitiveness. For XRP traders, especially those executing large trades, Tapbit is likely the better choice, as it can handle substantial orders without significantly impacting prices.

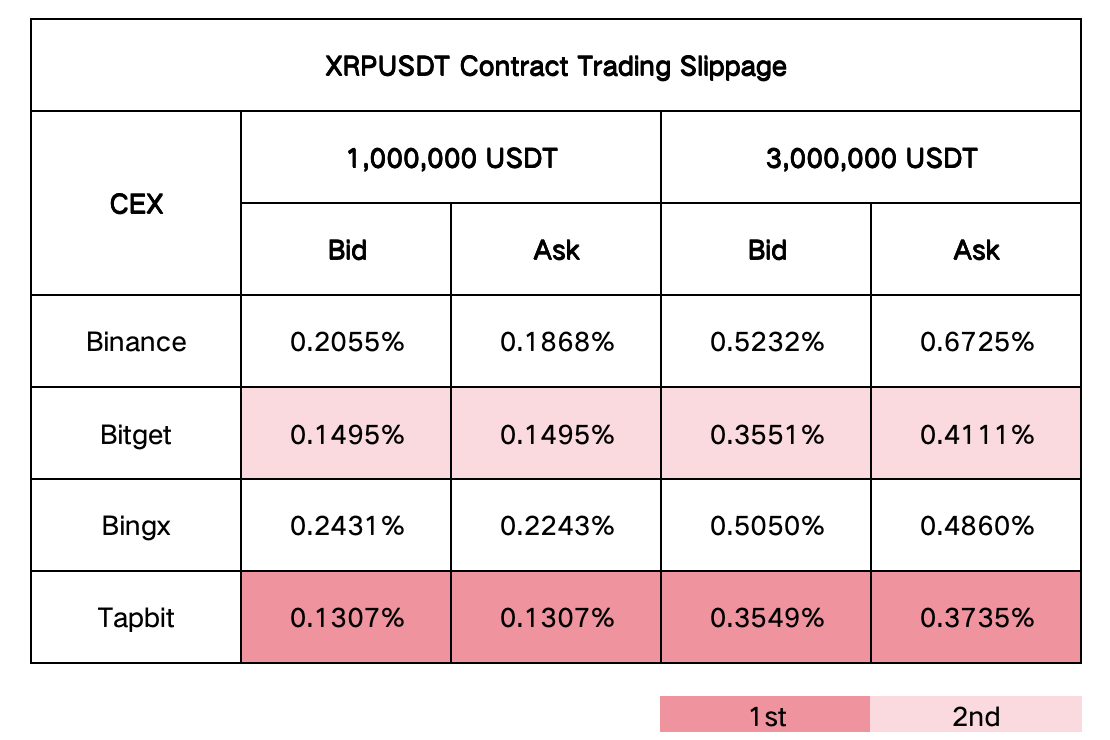

2. XRP Contract Slippage:

Data indicates that Tapbit has the best performance in controlling slippage for XRP contracts, offering the most stable and lowest slippage regardless of transaction size. Bitget also performs strongly, particularly for large trades. In contrast, Binance and BingX are relatively weaker in slippage control, especially when handling large orders.

For XRP traders, this suggests that Tapbit and Bitget may be preferable, particularly for those engaging in large transactions, as these platforms provide better price execution and lower transaction costs.

VI. Comprehensive Assessment

Overall, Tapbit performs exceptionally well in both the BTC and XRP perpetual contract markets, with the deepest order book depth and the lowest slippage. Its performance is particularly outstanding for large-volume trades, making it suitable for investors looking to minimize trading costs. Bitget shows stable performance in certain small-trade scenarios but lacks control over slippage in large trades. BingX performs moderately, better than Binance in some respects but still lags behind Tapbit in liquidity and slippage control.

VII. Implications for Investors

1. Transaction Costs and Execution Efficiency:

- Tapbit: Low slippage and deep order book depth mean that investors can complete large transactions close to market prices, significantly reducing costs. This is particularly important for users who frequently make large trades.

- Bitget: While it performs acceptably for small trades, the slippage for large trades is significant, which may increase costs. Investors should carefully consider the risks of executing large orders on this platform.

- BingX: With moderate performance, it is suitable for general and medium-sized trading needs.

2. Platform Selection Recommendations:

- For investors who prioritize liquidity and low-cost execution, Tapbit is undoubtedly the best choice, especially for large transactions.

- Bitget is suitable for investors who frequently engage in small transactions, but if planning large trades, other options may need to be considered.

- BingX is suitable for users who do not have high liquidity requirements and who value diversity and overall stability.

VIII. Conclusion

Tapbit possesses a considerable advantage in liquidity, making it the preferred platform for investors looking to execute large trades with lower transaction costs. While Bitget and BingX serve distinct types of investors, they generally do not match Tapbit’s performance in this area. Investors need to evaluate their trading volume, frequency, and other specific needs when selecting a trading platform to ensure they achieve the optimal trading experience and effective cost management.