This guide cuts through the noise to examine the timing question every investor is asking. We analyze whether current conditions signal a prolonged crypto winter or a temporary liquidity crisis, providing the framework you need to navigate this volatile period with actionable insight into the signals that matter most.

Market Under Siege

The cryptocurrency market is confronting its most severe challenge of 2025 as Bitcoin‘s sharp decline below $90,000 ignites fierce debate about whether this represents the beginning of a prolonged bear market. The deterioration has been both rapid and severe, with the total crypto market capitalization collapsing to $3.12 trillion after experiencing a staggering 16.4% monthly decline that has wiped out hundreds of billions in value.

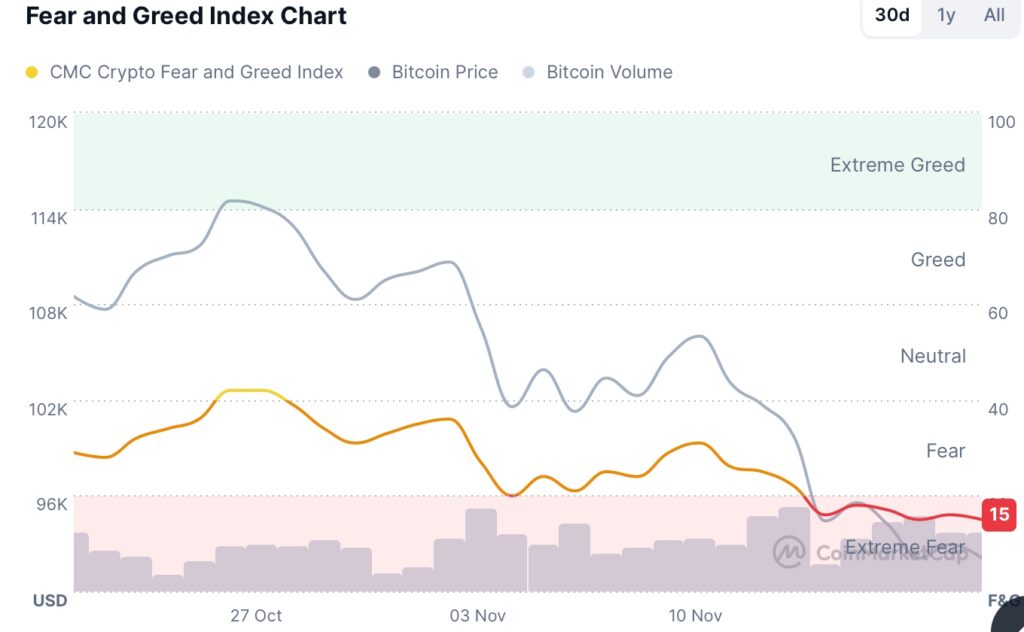

This massive sell-off has pushed market sentiment into alarming territory. The widely monitored Crypto Fear and Greed Index has plummeted to 15, solidifying its position in “Extreme Fear” range. This psychological gauge reflects escalating panic among investors and marks the most fearful market environment since the depths of the 2022 crypto winter, suggesting a fundamental breakdown in investor confidence.

The reversal of fortunes has been particularly dramatic for Bitcoin itself. Having now fallen below $92,000, the pioneer cryptocurrency has effectively erased all its gains for the year. This represents a stunning about-face from its historic peak of $126,272 reached on October 6th, with a 28% decline from that high clearly indicating a deepening bear market trend as Bitcoin struggles to maintain the $90,000 support level.

The selling pressure has proven comprehensive across the digital asset spectrum. Bitcoin’s failure to hold multiple critical support levels has triggered a domino effect throughout the ecosystem, with major altcoins and decentralized finance tokens suffering even steeper declines. The velocity and magnitude of this correction have caught many market participants off guard, especially given the optimistic institutional adoption narrative that characterized the beginning of the year, highlighting the complex interplay between macroeconomic pressures and crypto-specific dynamics.

Market Analysis: Is The Crypto Bear Market Here? Decoding The Mixed Signals

The cryptocurrency market is currently sending wildly conflicting signals, leaving investors grappling with a critical question: are we on the brink of a sustained bear market or witnessing a painful transition into a new institutional-driven era? Let’s decode the bullish and bearish narratives shaping the market’s trajectory.

The Bull Case: Unprecedented Institutional Adoption

The most compelling arguments against an impending bear market come from groundbreaking developments in traditional finance.

- A Historic Financial Bridge: The State of New Hampshire has launched the first official U.S. Bitcoin bond, effectively opening the massive $140 trillion global debt market to Bitcoin. This move transforms Bitcoin from a speculative asset into a yield-generating instrument for conservative investors, creating an entirely new demand channel.

- Wall Street’s Stamp of Approval: Goldman Sachs’ disclosure of a $1.7 billion Bitcoin purchase underscores a seismic shift in institutional sentiment. This level of commitment from a top-tier investment bank provides formidable buying pressure and legitimacy that previous bull cycles lacked.

- The Unshakable Narrative: With 95% of all Bitcoin now mined, its core value proposition as “digital gold” is stronger than ever. The rapidly diminishing new supply, combined with the potential for new institutional demand, creates a powerful long-term bullish thesis based on sheer scarcity.

The Bear Case: Weak Technicals And Dwindling Retail Momentum

Despite the strong fundamental backdrop, short-term market health appears concerning.

- Persistent Liquidity Drain: DEX volume remains down 60% since the October crash, indicating that the DeFi and retail trading ecosystem has not recovered. Thin liquidity makes the market vulnerable to sharp downturns and discourages new speculative capital.

- Abysmal Price Performance: Bitcoin is recording its weakest Q4 performance in seven years. Such technical weakness often becomes a self-fulfilling prophecy, triggering further selling from momentum-based traders and algorithms.

- The “Cramer Curse”: While often contrarian, Jim Cramer’s pronouncement that “markets must drop more” reflects a pervasive fear in traditional finance. A major stock market correction could easily drag crypto down due to its current high correlation with risk assets.

Synthesis: Transformation, Not Capitulation

Synthesizing these conflicting signals, the most plausible conclusion is that we are experiencing a structural market transition, not a classic bear market cycle.

The pain is real, but it is concentrated in the retail and DeFi sectors, as evidenced by the plunge in DEX activity. Simultaneously, the foundational pillars of the market are being reinforced by institutional capital and innovative financial products like the Bitcoin bond. This suggests a “changing of the guard,” where the market’s driver is shifting from retail speculation to institutional allocation.

For investors, this implies a need for strategic patience. Short-term volatility, driven by liquidity concerns and macroeconomic fears, is likely to continue. However, the long-term trajectory, built on scarcity and institutional adoption, remains fundamentally intact. The current consolidation phase, while painful, may ultimately lay the groundwork for a more mature and stable market. The key is to distinguish between a temporary liquidity crunch and a permanent impairment of Bitcoin’s value proposition—the data strongly suggests the former.

Why Choose Tapbit Exchange?

- Zero Trading Fees: Trade major pairs like BTC and ETH with no spot trading fees.

- No KYC Required: Start trading instantly without mandatory identity verification.

- Strong Security: Protected by a $50M insurance fund and transparent Proof of Reserves.

- Powerful Features: Access high-leverage futures (up to 100x), copy trading, and over 700 cryptocurrencies.

For a detailed analysis of Tapbit’s features and security measures, we recommend reading our comprehensive review: ‘Tapbit Review | Why Should You Consider Tapbit Exchange in 2025-2026?‘

Find us on: