Comparative Analysis of Perpetual Contract Liquidity Among Cryptocurrency Exchanges (Jan 10,2024)

Liquidity is one of the core competitive advantages of cryptocurrency exchanges. High liquidity not only provides investors with lower transaction costs but also ensures efficient execution of large orders and market price stability. This article analyzes the liquidity performance of BTCUSDT and ETHUSDT perpetual contracts across three major trading platforms—B*T, B*X, and Tapbit—examining differences in trading experience across three dimensions: order book depth, bid-ask spread, and slippage, to help investors make more informed choices.

II. Research Methodology

– Comparison Objects: B*T, B*X, and Tapbit

– Comparison Subjects: BTCUSDT and ETHUSDT

– Key Liquidity Indicators:

– Order Book Depth

– Bid-Ask Spread

– Slippage

III. BTC Perpetual Contract Liquidity Analysis

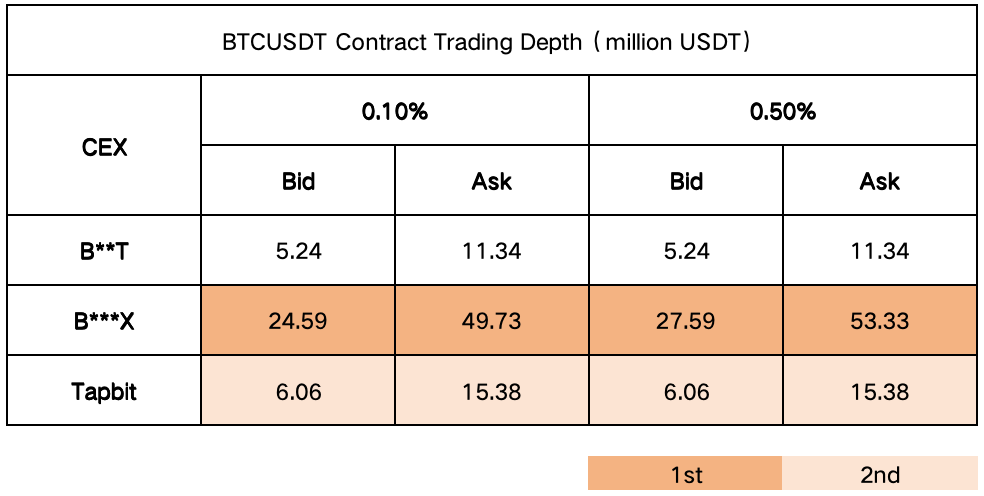

Below are the order book depth, bid-ask spread, and slippage situations for BTCUSDT contracts across various platforms:

Trading Depth Analysis:

B*X shows outstanding performance, particularly at larger market depths (0.50%), where its data significantly outperforms the other two platforms. Specifically, B*X is suitable for large transaction needs. In comparison, Tapbit shows stable depth data, ranking second in both BTC and ETH contract depth, making it a balanced choice.

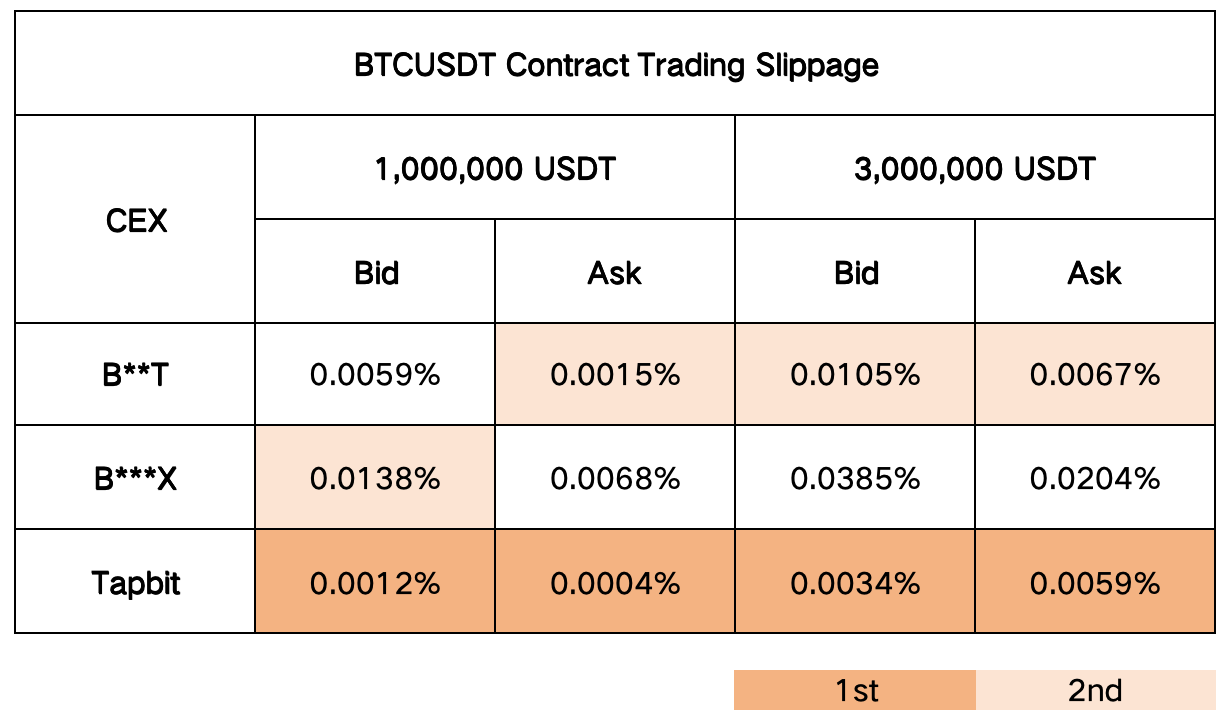

Slippage Analysis:

Tapbit performs exceptionally well in terms of slippage. In both BTC and ETH perpetual contracts, Tapbit maintains low slippage levels. For example, at 1 million USDT trading volume, Tapbit’s BTC contract slippage is only 0.0004%-0.0012%, indicating significant advantages in maintaining price stability and reducing transaction costs.

Comprehensive Evaluation:

In terms of BTCUSDT perpetual contract trading depth, B*X undoubtedly holds an advantage, performing best at both 0.10% and 0.50% market depths, significantly outperforming B*T and Tapbit. However, in slippage control, Tapbit shows excellent performance, particularly at 1 million and 3 million USDT trading volumes, with notably lower slippage than other platforms. This indicates Tapbit’s strong competitiveness in maintaining stable trading prices, while B*X is suitable for large transactions requiring high depth support.

IV. ETH Perpetual Contract Liquidity Analysis

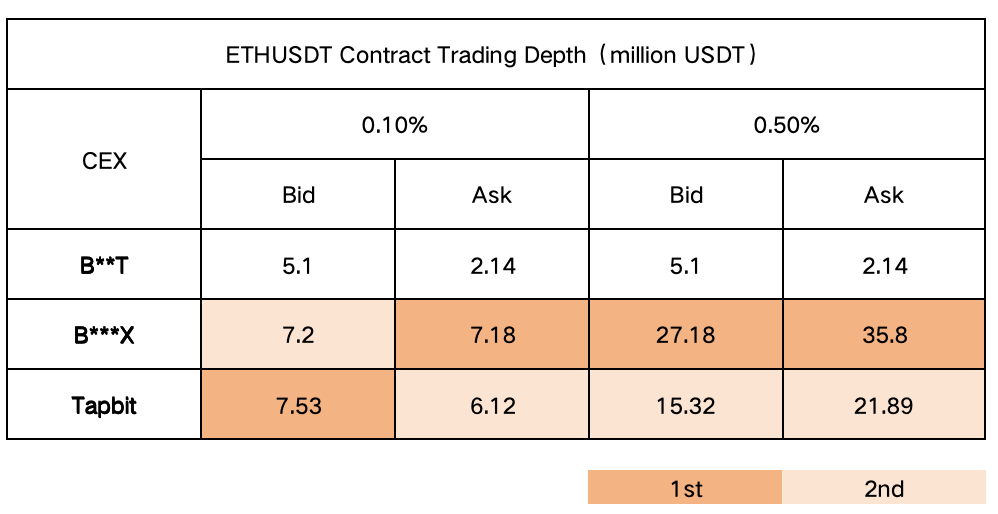

For ETHUSDT contracts, the platforms show the following highlights:

Trading Depth Analysis:

Tapbit’s trading depth shows strong competitiveness, particularly at 0.10% depth, slightly higher than B*X. At 0.50% depth range, Tapbit continues to lead, while B*X shows larger depth but slightly higher volatility. B*T shows the lowest depth.

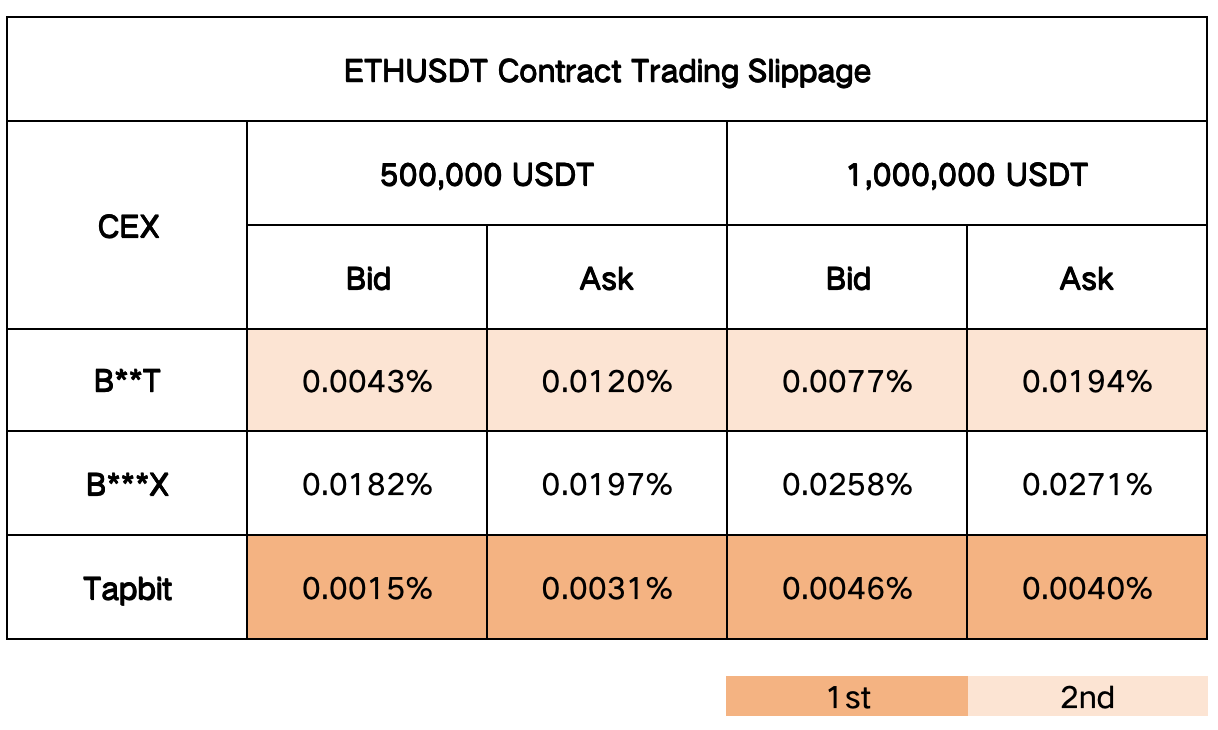

Slippage Analysis:

Tapbit’s slippage data ranges from 0.0015%-0.0046% at 500,000 USDT and 0.0031%-0.0040% at 1,000,000 USDT trading volumes. In comparison, B*X shows relatively higher slippage, especially for large transactions. B*T’s slippage falls between the two but shows higher volatility in large transactions.

Comprehensive Evaluation:

For ETHUSDT perpetual contracts, Tapbit shows balanced performance in both order book depth and slippage control. In trading depth, Tapbit slightly outperforms B*X, especially showing more stable data at larger market depths. The slippage data again highlights Tapbit’s competitiveness, with low slippage suitable for investors focused on transaction costs. In comparison, B*X shows relatively higher slippage but still provides strong support for large transactions through its depth.

VI. Overall Assessment

Overall, B*X is suitable for large transaction needs due to its deeper order book, and Tapbit provides a more economical trading experience with its low slippage advantage. While B*T shows no clear advantages in these indicators, it maintains consistent liquidity to some extent. Investors can choose the appropriate platform based on own trading strategies.