Liquidity is one of the core competitive advantages of cryptocurrency exchanges. High liquidity not only offers investors lower trading costs but also ensures the efficient execution of large orders and market price stability. This article analyzes the liquidity performance of three major trading platforms—B*T, B*X, and Tapbit—in BTC and XRP perpetual contracts. It examines the differences in trading experience across platforms from three dimensions: order book depth, bid-ask spread, and slippage, thereby helping investors make more informed choices. II. Research Methodology Comparison Targets: B*T, B*X, and Tapbit

Contracts Compared: BTC and XRP

Key Liquidity Indicators:

Order Book Depth

Bid-Ask Spread

Slippage

III. Liquidity Analysis of BTC Perpetual Contracts

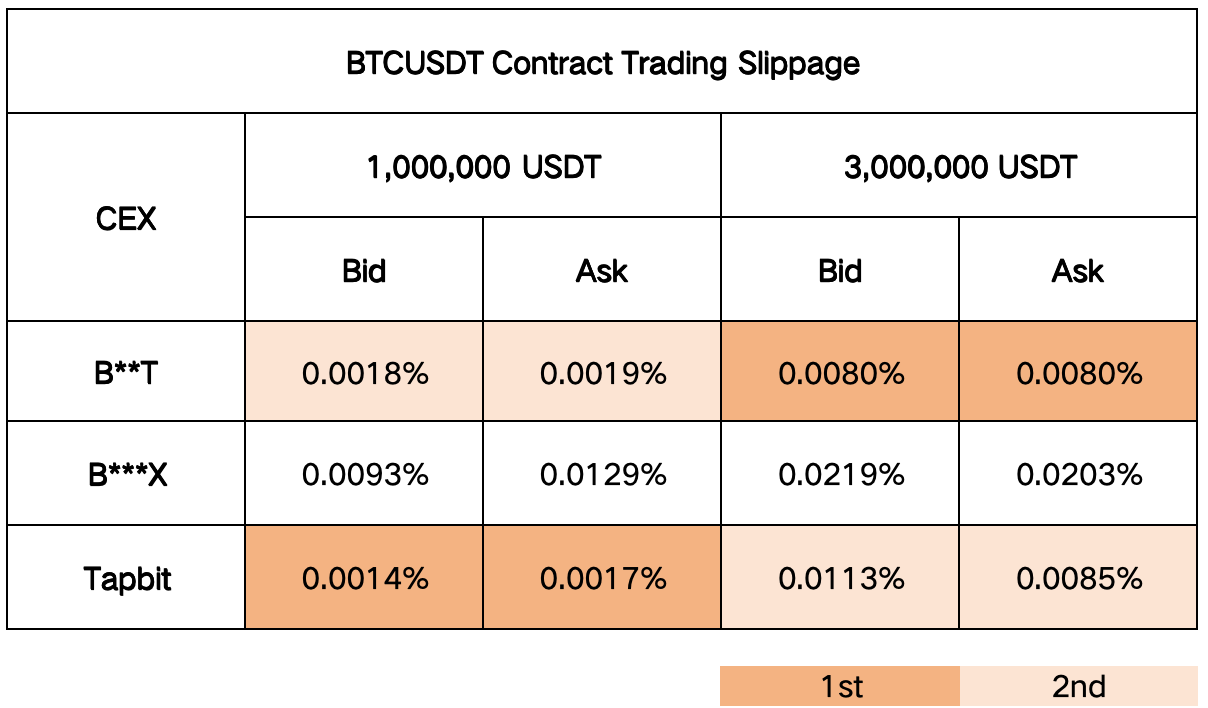

The trading depth, bid-ask spread, and slippage for the BTCUSDT contract on various platforms are as follows:

Summary:

In the BTC perpetual contract market, the liquidity performance across platforms shows a marked contrast. On one hand, the B*X platform, with its robust order book depth, is capable of providing ample order support for average-sized trades, which keeps the market active under normal trading conditions. However, this advantage falls short when handling large orders—the relatively high slippage indicates that despite sufficient order depth, price execution is impacted to some extent, potentially resulting in extra costs for investors during transactions.

On the other hand, B*T and Tapbit display more stable characteristics in the data. Although their order book depths are not as abundant as those of B*X, their lower slippage under large order pressures demonstrates better price stability. This smooth execution ability offers investors a greater safety cushion when facing extreme market conditions, effectively controlling cost fluctuations during trading. Overall, for investors seeking low costs and high execution efficiency, BT and Tapbit undoubtedly provide a more attractive trading experience.

IV. Liquidity Analysis of XRP Perpetual Contracts

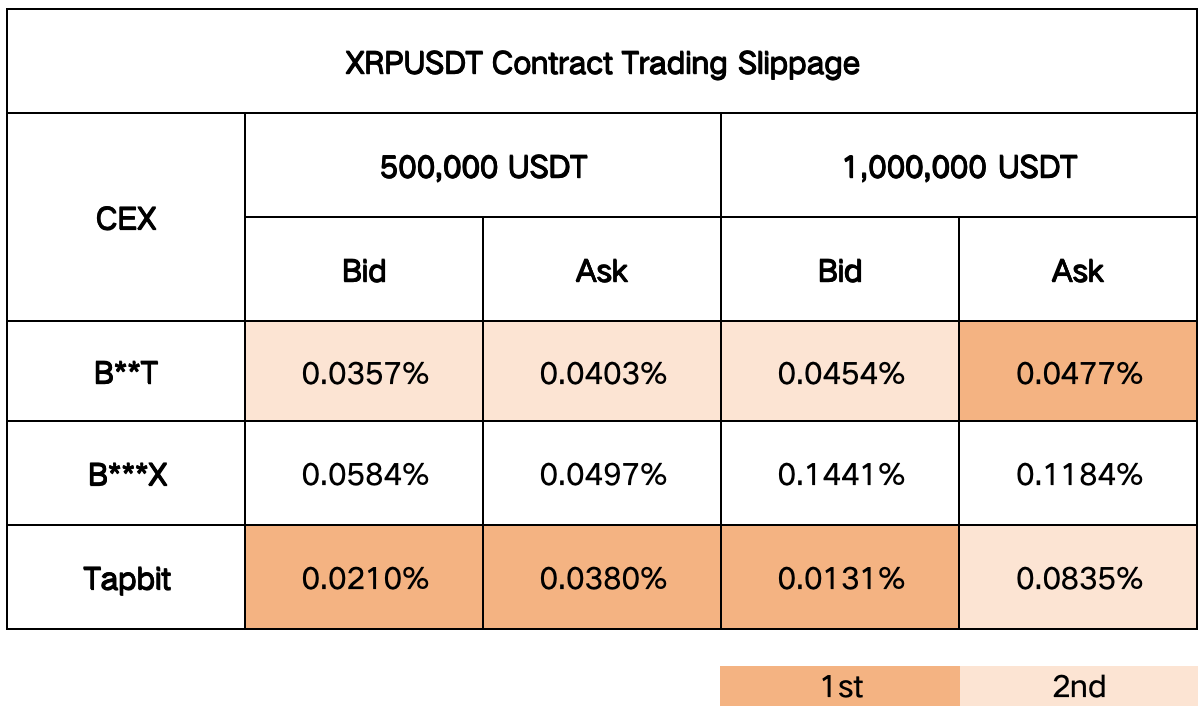

For the XRPUSDT contract, the performance of the platforms highlights the following points:

The liquidity performance in the XRP perpetual contract market exhibits more complex and multi-layered characteristics. The order book structures across platforms are more dispersed, particularly with noticeable differences between the first and second layers of orders. This variation results in diverse market responses when processing orders of different sizes. Although the B*X platform has higher order depth at certain levels, its significantly increased slippage when handling large orders reflects instability in price execution.

In contrast, B*T and Tapbit maintain a more balanced performance in the XRP market. Not only do they have a more reasonable distribution of orders in their order books, but their low slippage during large trades further confirms the advantages of their liquidity management. This robust multi-layered performance means that regardless of whether the orders are small or large-scale capital inflows occur, investors can enjoy a relatively smooth trading experience, thereby reducing potential trading cost risks.

VI. Overall Evaluation

Overall, each platform has its own merits. B*X, with its strong order book depth, can provide ample liquidity support during normal trading, but its higher slippage under large order pressure suggests that investors should operate with caution. In contrast, B*T and Tapbit exhibit more robust liquidity management. They not only ensure the necessary order book depth but also demonstrate strong resilience under extreme trading scenarios through their lower slippage. For traders pursuing low costs and high execution efficiency, these two platforms undoubtedly hold greater appeal.