This paper aims to analyze and compare the liquidity of mainstream trading platforms. Liquidity is a crucial indicator of trading platform quality, directly impacting user trading experience and costs. By analyzing order book depth, bid-ask spread, and slippage across these platforms, we can gain insights into their trading performance.

Research Methodology

Comparative Objects

– Bitget, BingX, and Tapbit

Comparison Assets

– BTC and ETH (randomly selected this week)

Key Liquidity Indicators

– Order book depth

– Bid-ask spread

– Slippage

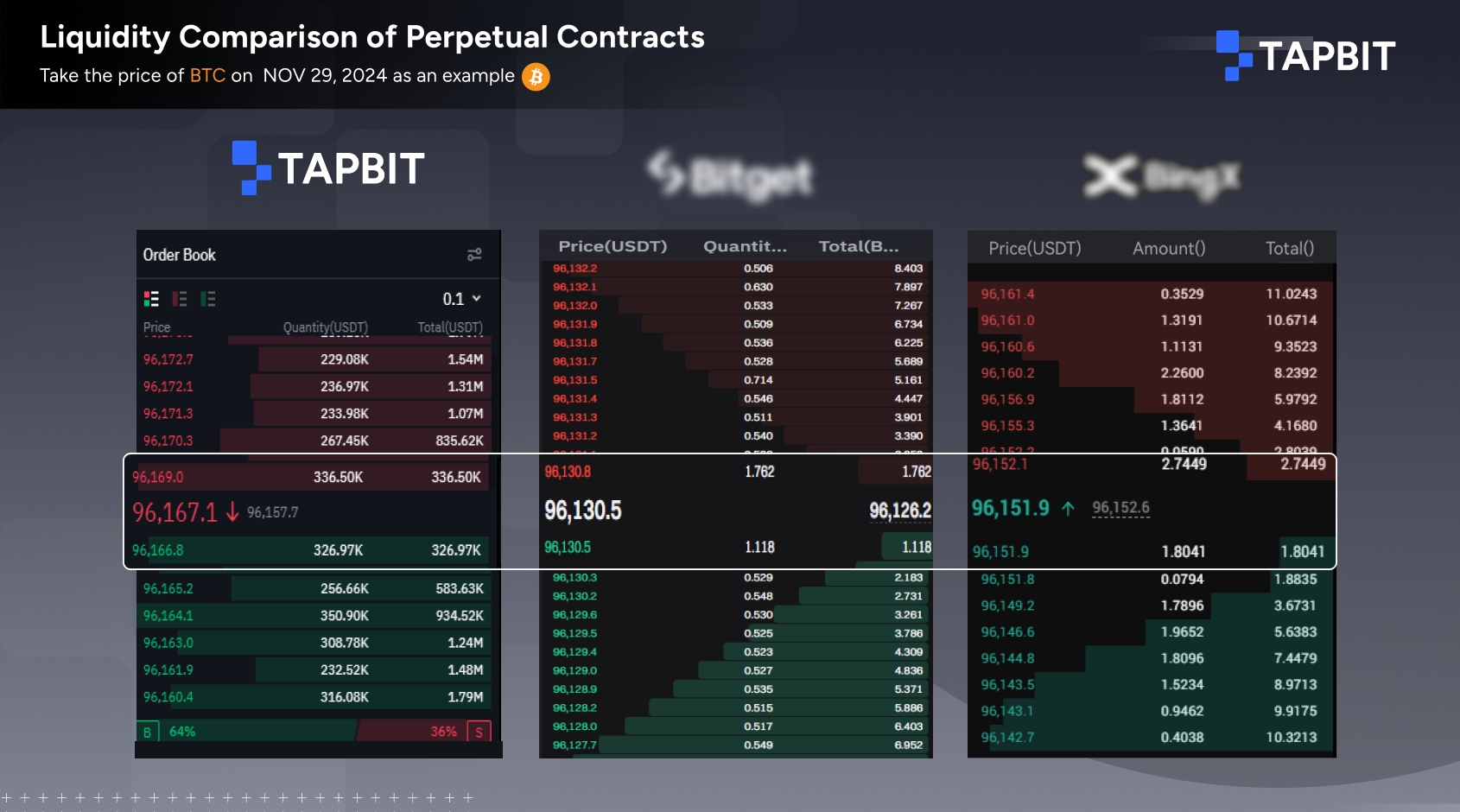

BTC Perpetual Contract Liquidity Analysis

In this week’s BTC contract trading, the platforms demonstrated distinct liquidity characteristics:

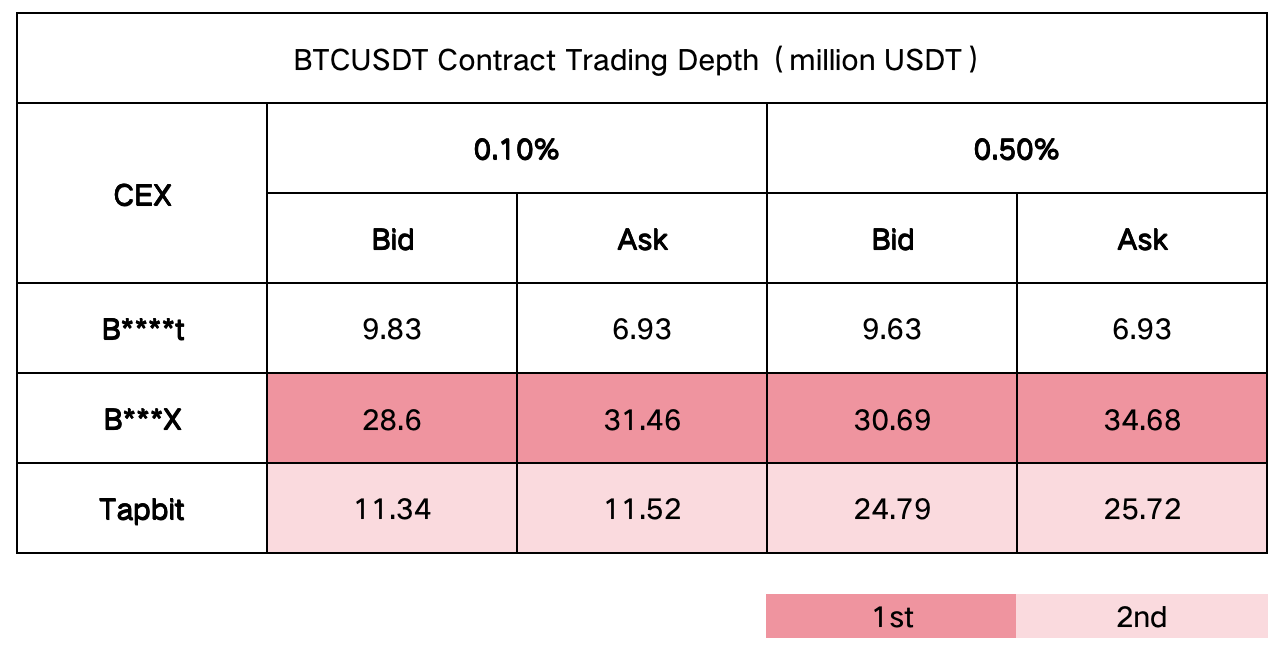

Order Book Depth

B***X showcased exceptional liquidity advantages. Whether in bid or ask depth, the platform stood out, providing robust trading capacity. This is particularly crucial for high-frequency and large-volume traders, as greater depth means the market can easily absorb massive buy and sell orders with minimal price impact.

Tapbit, while not matching B***X’s level, demonstrated balanced depth, especially in medium-volume trading ranges. B****T appeared slightly less competitive, with depth sufficient for daily trading but potentially struggling with large-volume transactions.

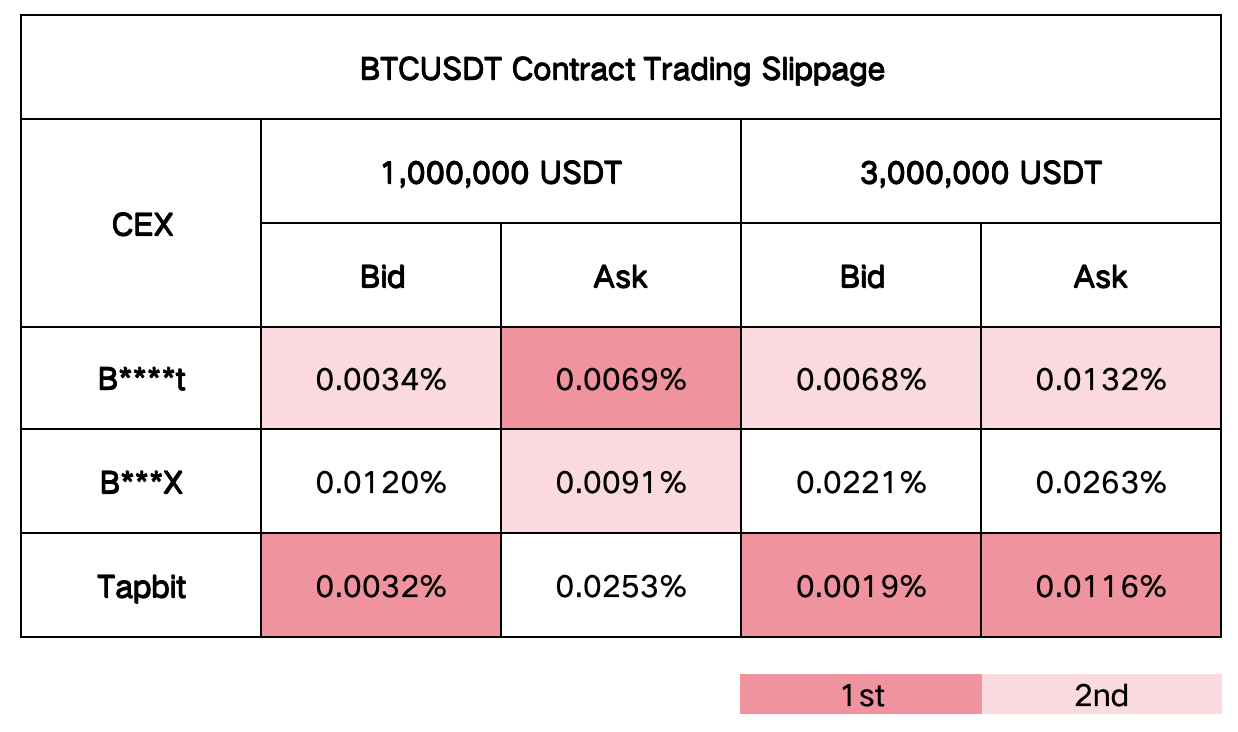

Slippage Performance

Tapbit emerged as the leader in slippage control. The minimal slippage directly translates to significant hidden cost savings for large-volume traders, especially in million-dollar-level transactions.

In contrast, B***X and B****T, despite strong liquidity depth, exhibited relatively higher slippage. This suggests potential price deviations in large-order executions, making them less suitable for users seeking precise cost control.

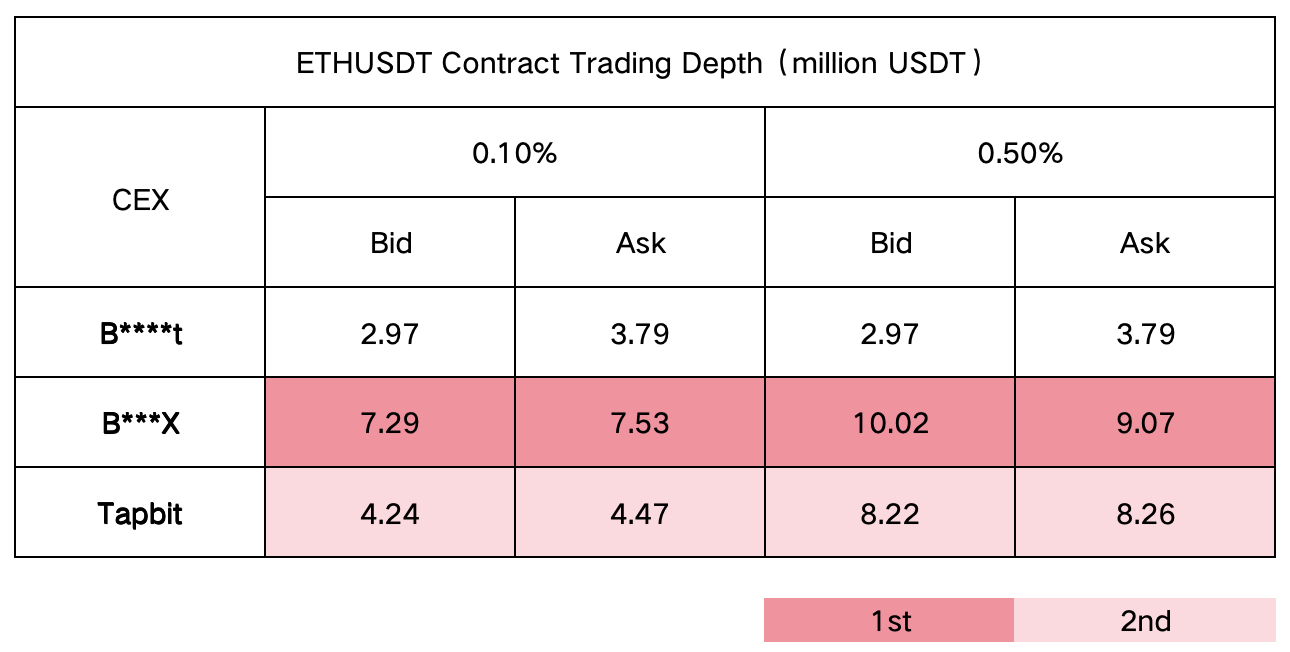

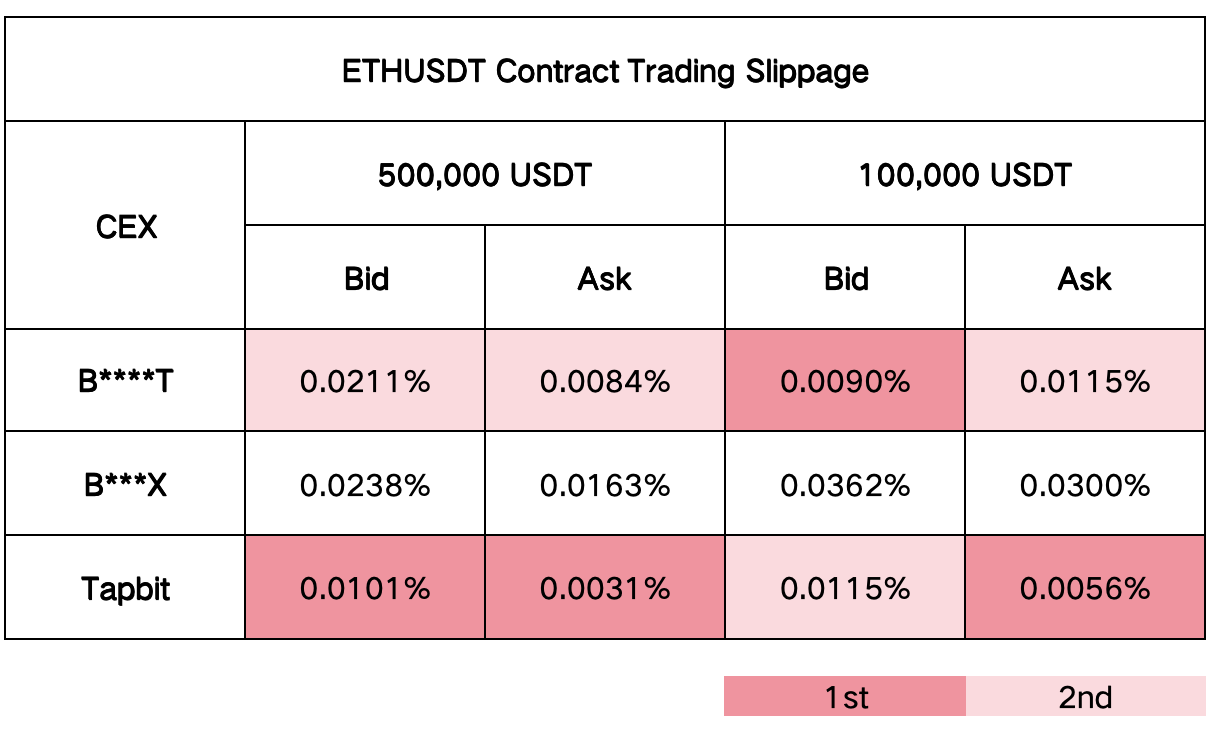

ETH Perpetual Contract Liquidity Analysis

Order Book Depth

B***X continued its strong performance in ETH contracts, maintaining a deep order book that supports high-frequency and large-volume trades. Tapbit showed steady performance, particularly suitable for medium-scale trading. B****T provided a basic yet adequate depth for beginners or low-volume traders.

Slippage Analysis

Tapbit maintained its excellence in slippage control, keeping price deviations minimal, especially in small to medium-scale trades. B****T performed reasonably but was outshined by Tapbit. B***X, leveraging its strong liquidity depth, still met most traders’ requirements.

Comprehensive Assessment

Each platform caters to different user needs:

– B***X: Ideal for high-frequency and large-volume traders due to deep order book liquidity

– Tapbit: Attracts users focused on trading efficiency and cost optimization through low slippage

– B****T: Offers a balanced, user-friendly option perfect for newcomers or small to medium-scale users

Traders should carefully evaluate depth and cost based on individual requirements to maximize trading experience and profitability.

Conclusion

The cryptocurrency derivatives market’s liquidity landscape is complex and nuanced. Platforms like B***X, Tapbit, and B****T demonstrate that liquidity is not a one-dimensional metric but a sophisticated interplay of depth, execution cost, and trading capacity. As the market continues to evolve, platforms that can provide comprehensive, efficient trading environments will stand out.